Smart Routing

At LYNX, you can add a stock to your trading platform in several ways. You can either choose a specific exchange (Directed order) or use SMART routing. The difference between these two options is explained below.

SMART routing only applies to electronically connected exchanges. Some exchanges, such as Börse Frankfurt (FWB), Börse Stuttgart (SWB), and Borsa Italiana (BVME), are excluded.

- When a financial instrument is added with SMART routing, quotes from these excluded exchanges may still appear in the overview, but the system cannot route SMART orders to them.

- If you want to execute an order on one of these exchanges, you must select Directed routing.

Explanation

When you request the prices of a particular stock, you can choose between two methods; namely SMART or directly on a specific exchange. Shares are often traded on multiple exchanges and it is up to you to choose which exchange you want to send your order to.

- If you choose the Direct method, you can select a specific exchange to which your order will be sent.

- If you choose the SMART method, then your order will be executed on the exchange that is currently quoting the most competitive price.

Benefits and drawbacks

- Access to a wider range of liquidity sources.

- Routing to available venues quoting competitive prices.

- Convenience of not having to choose an exchange manually.

- SMART orders may not participate in all auction mechanisms (e.g. Euronext).

- Orders may be executed on alternative venues, including outside regular trading hours.

- Transaction costs may vary depending on the exchange. These costs affect the final outcome.

Disclaimer

SMART routing is a technical tool designed to help route orders across connected venues. It does not guarantee the best available price, fastest execution, or access to all liquidity sources. Execution results depend on market conditions, exchange connectivity, and the type of order you submit.

Worst case scenario, an order may be executed at the best available price at that moment, but due to transaction costs on the specific exchange (or exchanges), the outcome could still be less favourable than what might have been achieved elsewhere. Smart routing only considers the most competitive trading price available at that time.

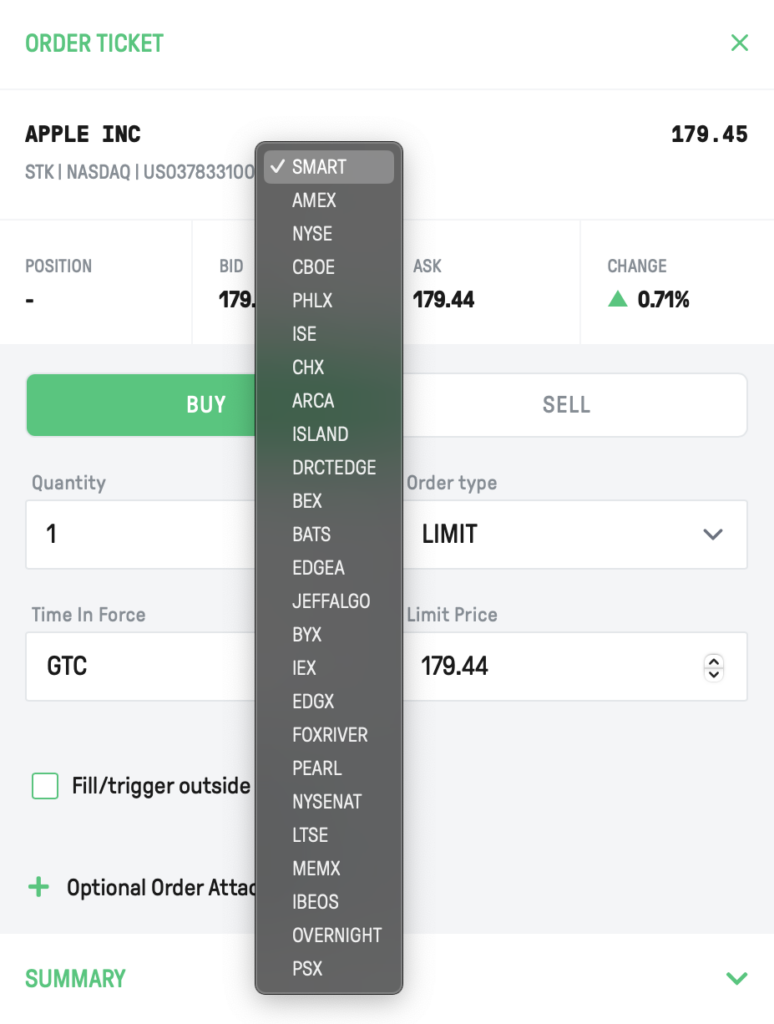

SMART Routing Order in LYNX+

Suppose you want to buy Apple stock (AAPL) and your order ticket opens up on the right side of your screen.

As shown in the image on the right, the default setting is SMART, but you can select a specific exchange if preferred.

Might you like to send the order direct to one of the possible exchanges, you can open up the menu and select the specific exchange.

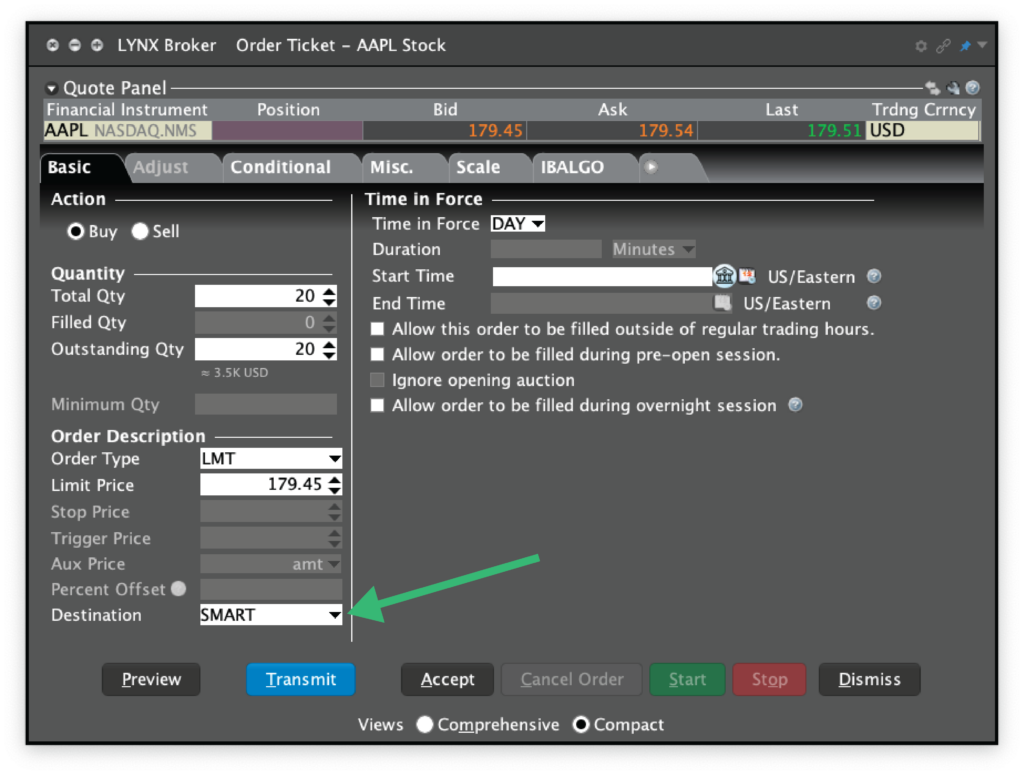

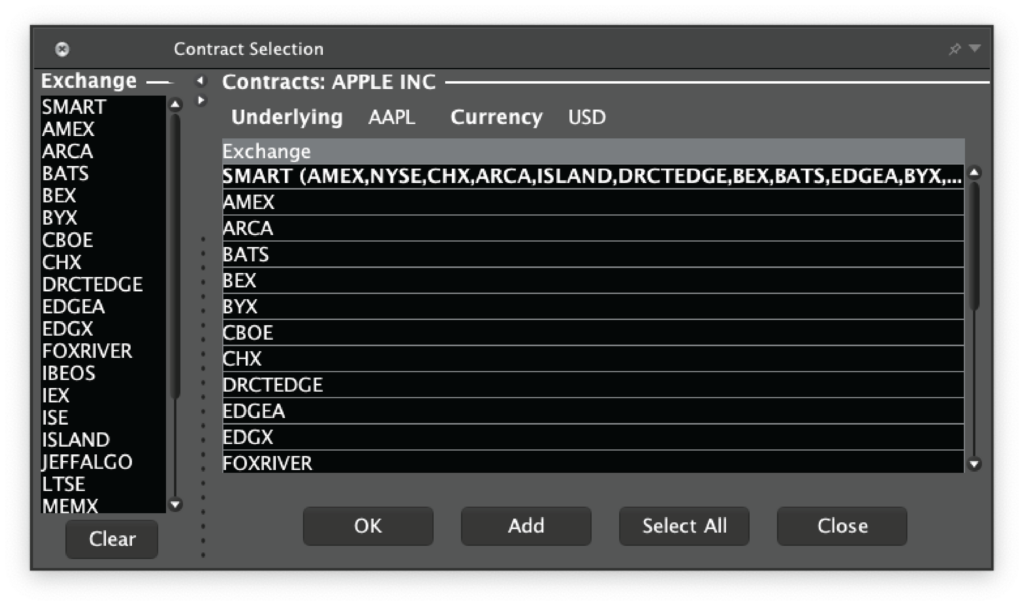

SMART Routing Order in TWS

Within TWS it is also possible to send orders directly to a specific exchange instead of SMART. Once you opened the order ticket and selected the financial instrument you would like to buy, you see as shown below multiple options.

- Stock (SMART)

- Stock (Directed)

Once you selected Stock (Directed), there will open up a menu with all the available exchanges. You can select your preference and fulfill the order ticket to submit it.

Smart Routing Order in the LYNX Trading App

Orders submitted through the LYNX Trading App will be automatically SMART Routed to the available exchanges.

Only when searching an asset with its ISIN-Code, it is possible to select a specific exchange for your order.

FAQ

What is the difference between SMART and Directed when adding a stock?

When requesting the quotes for a specific security, you have the option to choose between Stocks (SMART) and Stocks (Directed). Stocks are often traded on multiple exchanges, and it is up to you to decide to which exchange you want to send your order. If you choose Stocks (Directed), you can select a specific exchange to which your order will be routed. If you choose Stocks (SMART), your order is routed to an exchange quoting a competitive price at that time.

Can I control the routing of my orders?

You can freely choose between SMART routing and other available routing options. In both LYNX+ and TWS, you can customize your order routing preferences or select specific venues for execution.

How does SMART-routing handle non-marketable orders?

SMART-routing is designed to optimize execution quality by selecting the best available venue based on factors such as price, speed, and likelihood of execution. While this applies effectively to marketable orders, the behavior for non-marketable orders (e.g. limit orders placed outside the current bid/ask spread) differs significantly.

For non-marketable orders, IB uses what is referred to as SMART Multipurpose routing. As stated by Interactive Brokers:

“SMART Multipurpose (SMART-routing) – This is the basic smart-routing algorithm. It routes non-marketable orders (orders that add liquidity, such as buy/sell limit orders with a limit price below/above the current market) to the default exchange for the contract.”

Once such an order is routed to the default exchange, it typically remains there until it is either executed or cancelled. Unlike marketable orders, it is not dynamically rerouted to other exchanges if conditions change, unless the order becomes marketable or is modified by the user.

An important consideration is the handling of such orders when the default exchange closes. In this case, the order is temporarily deactivated and is only reactivated once the exchange reopens. During this period, even if the order becomes executable on another venue, it will not be filled, since it remains parked and inactive on the closed default exchange.

This behaviour can lead to missed execution opportunities on other available venues. Traders relying on SMART-routing for non-marketable orders should be aware that, in these cases, the routing logic is not continuously reassessed across markets during the life of the order.

For use cases requiring more dynamic reassessment across venues, it may be advisable to consider direct routing options or monitor orders actively during trading hours of the default exchange.

Important: Because SMART multipurpose routing parks non-marketable orders at a default exchange, execution opportunities on other venues may be missed. Traders who want continuous reassessment should consider direct routing or actively monitor their orders.