FX Conversion

Your trading account through LYNX is multi-currency, allowing you to trade in various countries using different currencies. This page provides instructions on how to make an FX conversion.

LYNX+

Navigate to the Portfolio Page

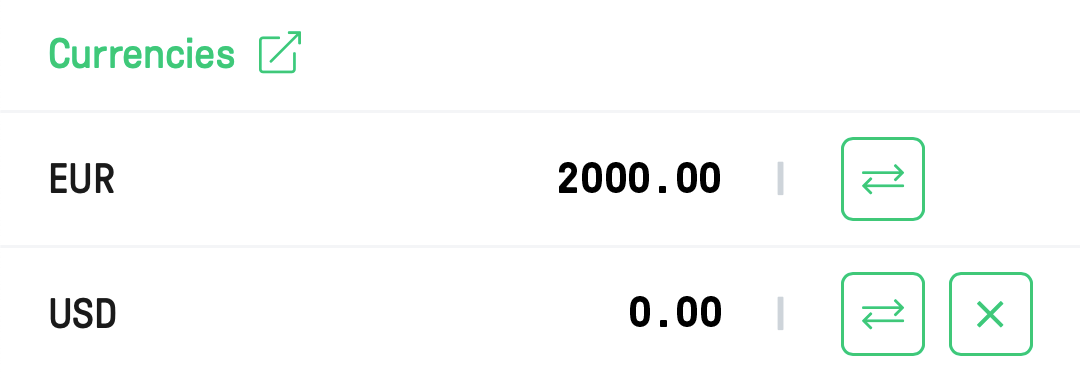

Navigate to the top of the LYNX+ platform and click on the Portfolio tab. Once on the Portfolio page, simply scroll down until you reach the Currencies section.

Select Currency

Click on the Convert button next to the currency you wish to convert. Afterward, select the currency you want to convert to and input the desired amount. Then, press Convert to open the order ticket.

To convert a foreign currency position back to your base currency, you can use the close position feature. Start by selecting the Portfolio tab from the main menu, then navigate to the Currencies section. Find the foreign currency position you wish to close and click on the X (close) button beside it. This action will prompt an order ticket to open automatically, pre-filled with relevant details.

Note: The generated order is always a limit order, which may not execute immediately upon transmission. Alternatively, you have the option to manually adjust the order ticket.

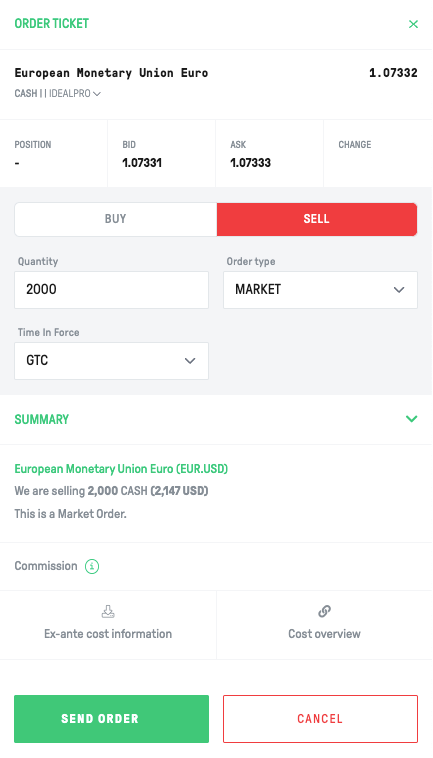

Configuring an Order Ticket

On the right-hand side, you find your desired currency conversion. Feel free to customize the following parameters:

- Quantity: Specify the number of units of your selected currency for the exchange.

- Order Type: Select your preferred order type, such as Limit, Market, Stop, or Trail.

- Time In Force: Determine the duration of the order’s validity. You can opt for GTC (Good-Til-Cancelled), DAY, or GTD (Good-Til-Date).

- Price: Depending on the chosen order type, you’ll be prompted to input a limit price, stop price, or trail amount.

If you are comfortable with the order ticket settings, you can submit it by clicking on the Send Order button. Depending on the order details, your currencies might be converted immediately or be pending in the Open Orders tab.

Trader Workstation

Adding a Currency pair

To make a currency conversion, you first need to add the desired currency pair in the Watchlist section. For example, if you want to convert Euros to US Dollars, you need to enter “EUR.USD“ in the Financial Instrument column. Remember that the individual currencies within the currency pair should be separated by a dot instead of a slash.

Alternatively, you can locate the currency pair within the Forex tab, where all common currency pairs are listed.

Order Configuration for FX Conversion

Once a currency pair is added to your Watchlist, you should right-click on its name and select either Buy or Sell. This choice relates to the first currency listed in the pair. For instance, if you select Sell, it means you’re selling the first currency and buying the second one.

Subsequently, an order line will appear, enabling you to configure its specific parameters. Finally, transmit the order by clicking the designated T-button.

Tip: If you would like to configure the order in more detail, you can open an Order Ticket. To do this, right-click on the order line, hover over Modify, and select Order Ticket. Once you have configured the order, submit it by clicking the Transmit button.

To convert a foreign currency position back to your base currency, you can use the close position feature. Start by clicking on the Account icon located in the top left corner. If the icon is not visible, navigate to the main menu, select Account, and then choose Account Window. From there, scroll down to the Market Value-Real FX Balance section. Right-click on the foreign currency position you wish to close and select Close Currency Balance. This action will automatically open an order ticket, pre-filled with relevant details.

Note: The generated order is always a limit order, which may not execute immediately upon transmission. Alternatively, you have the option to manually adjust the order ticket.

LYNX Trading App

Navigate to the Portfolio section

Navigate to the main menu and select Portfolio. In the Cash Balances area, tap the currency you wish to convert.

Convert or Close Balance

The LYNX Trading App will present you with two distinct choices: Convert or Close Balance. If you wish to convert all the cash in a specific currency to the base currency, opt for Close Balance. Should you intend to convert only a part of cash in a given currency to the base currency, or if you want to convert to a currency other than the base currency, simply tap the Convert button.

Order Configuration for FX Conversion

In the final step, you need to configure the parameters of the currency conversion and then transmit the order using the slider.

FAQ

This issue is most often caused by one of the following four scenarios:

- You do not have sufficient cash in the base currency to cover the conversion commission

Conversion fees are always paid in the base currency of the account.

- You are using a market (MKT) order and want to convert the entire amount of cash in that currency

If you use a market order, the system will automatically reserve approximately 102% of the amount you intend to convert. If you wish to exchange all the cash in a given currency, you need to place a limit order.

- Your cash is not settled

Settlement of currency conversions takes two business days (T+2). The exception applies to the USD.CAD currency pair, where the settlement period is set at T+1. If a currency conversion order is routed to IBFX, it will be settled immediately.

It is not possible to make purchases of financial instruments with unsettled cash in a cash account. This does not apply to margin accounts.

- You have other active pending order(s)

If you have pending order(s) in your account, the system will not allow you to submit a new order if the combined requirements of pending and new orders exceed the available funds in your account.

Navigate to the Portfolio page, then scroll down until you reach the Currencies area on the right-hand side.

Click the Account button located at the top left corner. Look for the Market Value – Real FX Balance section to view the cash you have in each currency.

Access the main menu and select Portfolio. Under the Cash Balances area, you will find the individual currencies you hold in your account.

Leverage trading on the spot interbank FX market is not possible. However, you can trade leveraged FX using financial derivatives such as CFDs or futures contracts.

Please note that this does not apply to Swiss client accounts as these are still held under the IBUK structure.

No, a cash account typically needs to have enough settled cash in its quote currency to buy a financial instrument. In the case of a margin account, it’s possible to borrow cash for purchasing financial instruments. However, please be aware that there is an interest cost associated with borrowing currency.

Please keep in mind that if your foreign currency balance falls below the equivalent of 5 USD, the system will automatically convert it to the base currency without any charges.

The trading account is designed specifically for trading financial instruments and is not intended to be used primarily for currency conversions and subsequent withdrawals. Interactive Brokers (IB) provides currency conversion services for clients who mainly trade foreign securities or financial derivatives.

Please be aware that if your trading account is used primarily for currency conversions and subsequent withdrawals, IB may impose restrictions on your ability to withdraw converted currencies.