Options Trading

This page provides structured, step-by-step guidance on how to access and use options trading functionalities within the LYNX platform. Whether you are getting started or already familiar with options, the information below will help you understand how to build, adjust, and monitor multi-leg strategies, place orders, and manage positions effectively.

Options are complex financial instruments that carry the risk of substantial loss and are not suitable for every investor.

Getting started

Activate Options Trading

Before trading options, you must request and receive the appropriate Trading Permissions in your account.

This ensures suitability and alignment with your investor profile. On this page, you will find clear step-by-step instructions for activating options trading.

Search Products

Use our platform’s search functionality to explore available listed options, tools, and resources that match your investment preferences. Options trading may not be suitable for every investor, ensure that the products align with your objectives and risk profile.

Create Orders

Once your trading permissions are active, you can create and submit orders for various option strategies. The platform supports different order types, enabling you to implement trades with care and precision. Always ensure you understand the characteristics and risks of each order type before submitting.

Evolve your Options trading

Gain insight into more advanced options strategies and tools that can support the further development of your trading approach.

Option Combinations

Explore the various strategies that arise from combining different options contracts. Combinations can be powerful tools for managing risk and maximizing profit potential in the world of options trading.

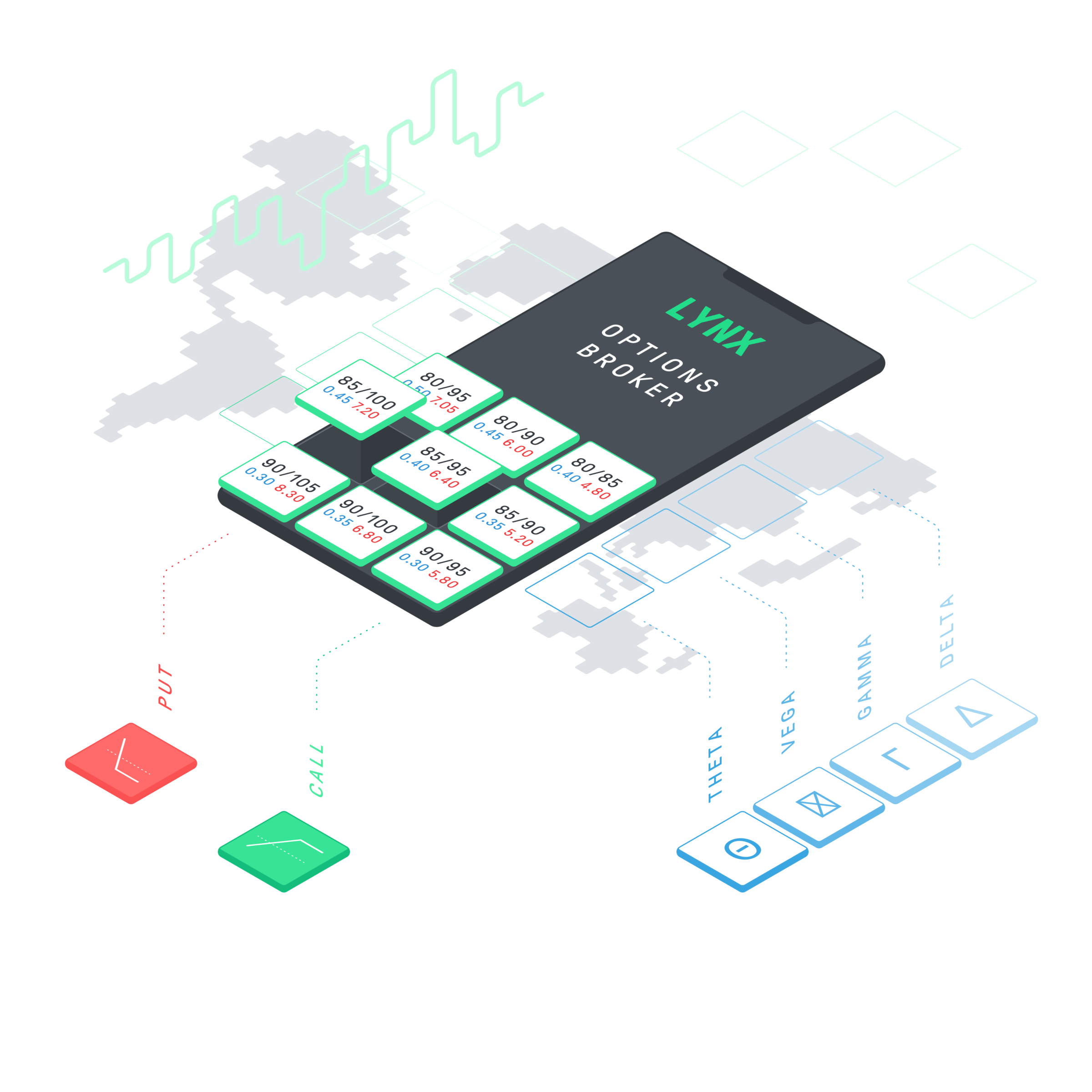

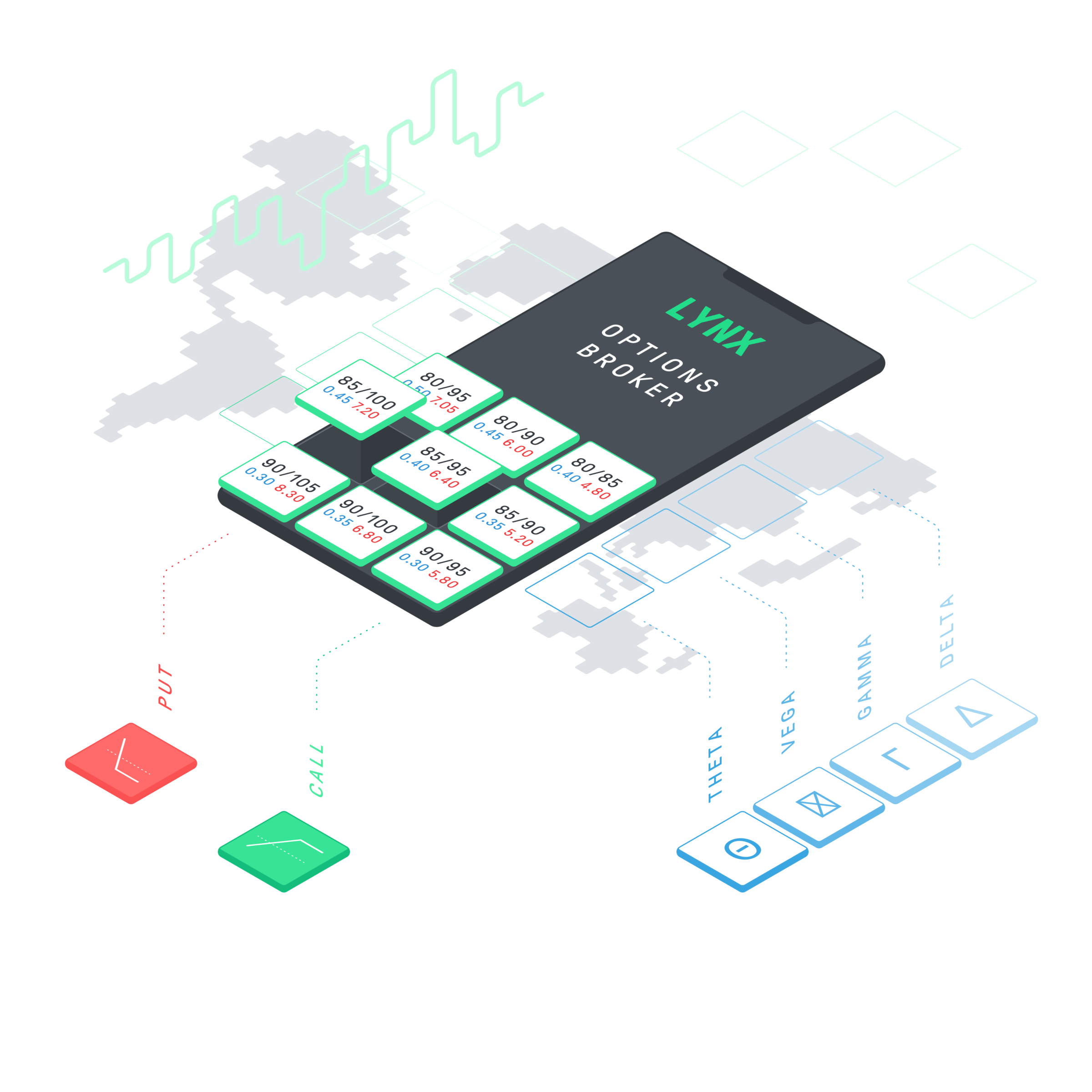

Discover the OptionTrader

Learn how combining different options contracts can form specific strategies, such as spreads, straddles, or strangles. These combinations may be used for hedging, income generation, or directional trading. However, they often involve higher complexity and risk exposure. Ensure you fully understand the mechanics before applying these strategies.

Observe positions and react correctly

Active monitoring of your options positions is essential. Options are time-sensitive instruments, and their value can change rapidly due to market developments or approaching expiry.

Exercise Options

Understanding when and how to exercise an option is a key part of options trading. Early or automatic exercise may apply depending on the instrument. Make sure you’re aware of the implications for your margin and portfolio.

Roll Options

Rolling refers to closing an existing position and opening a new one, typically with a different expiry or strike price. This may help adjust exposure, but also involves transaction costs and renewed risk. Consider the purpose and potential outcomes before rolling a position.

Calculate your Profit/Loss

Options P&L is influenced by multiple factors: premium, time decay, volatility, transaction costs, and corporate actions. Use your Account Statement to review and calculate your realized and unrealized gains or losses. This helps you assess the effectiveness of your strategies over time.