Bond Scanner

With LYNX, you can access a wide range of bonds worldwide. In this article, you will learn how to search for bonds using the Bond Scanner in Trader Workstation (TWS) and the LYNX Trading app, and how to place an order.

Searching a Bond matching your criteria

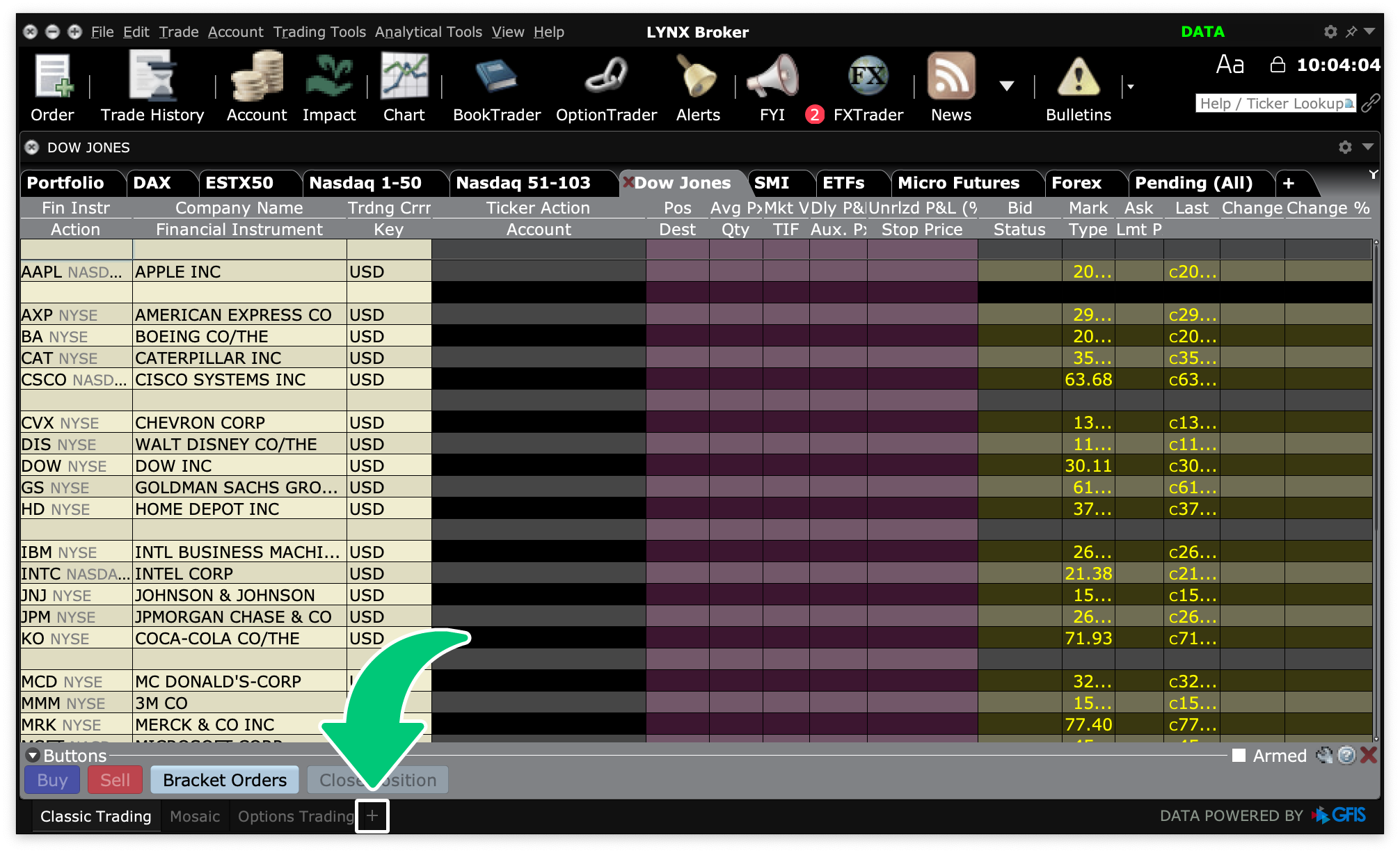

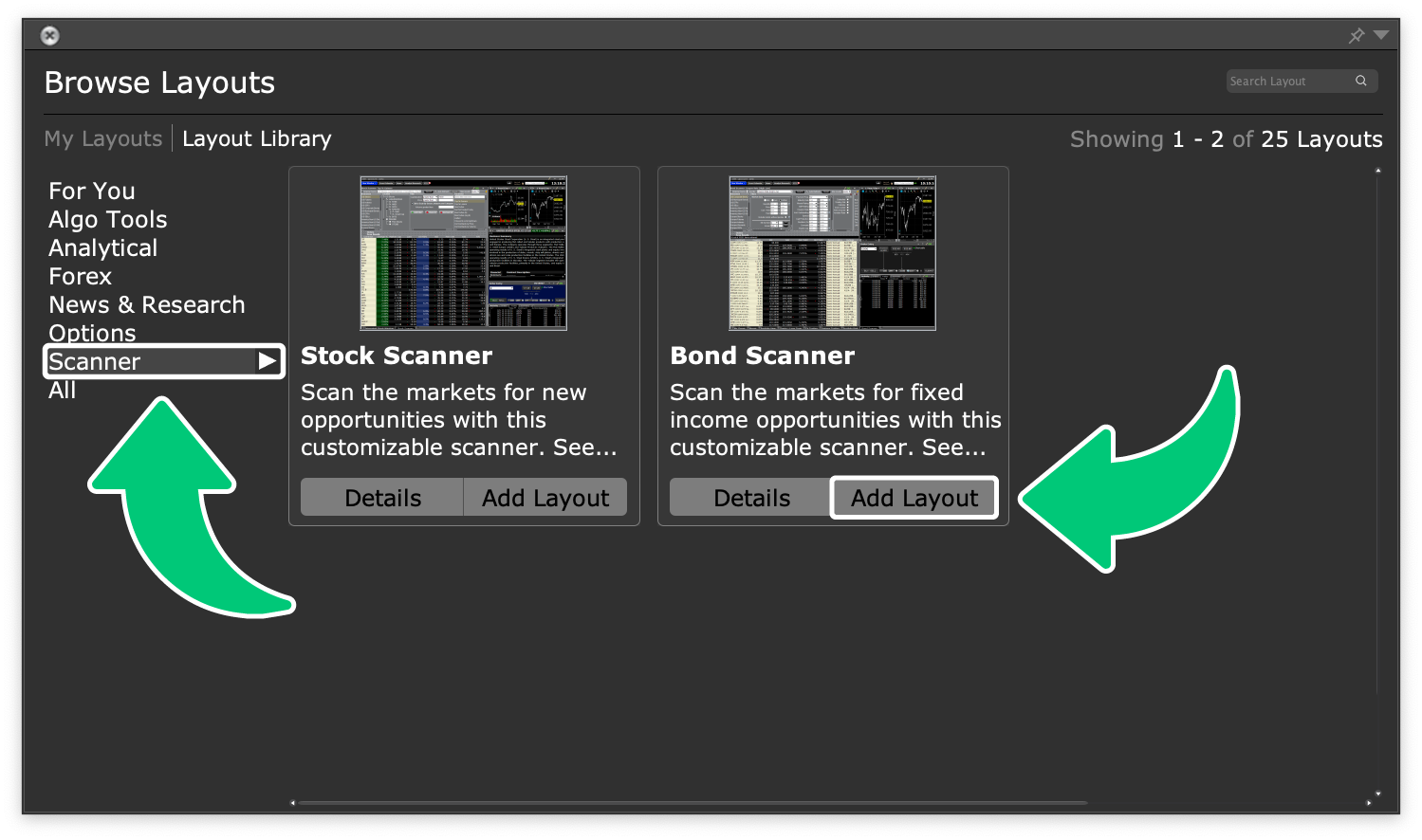

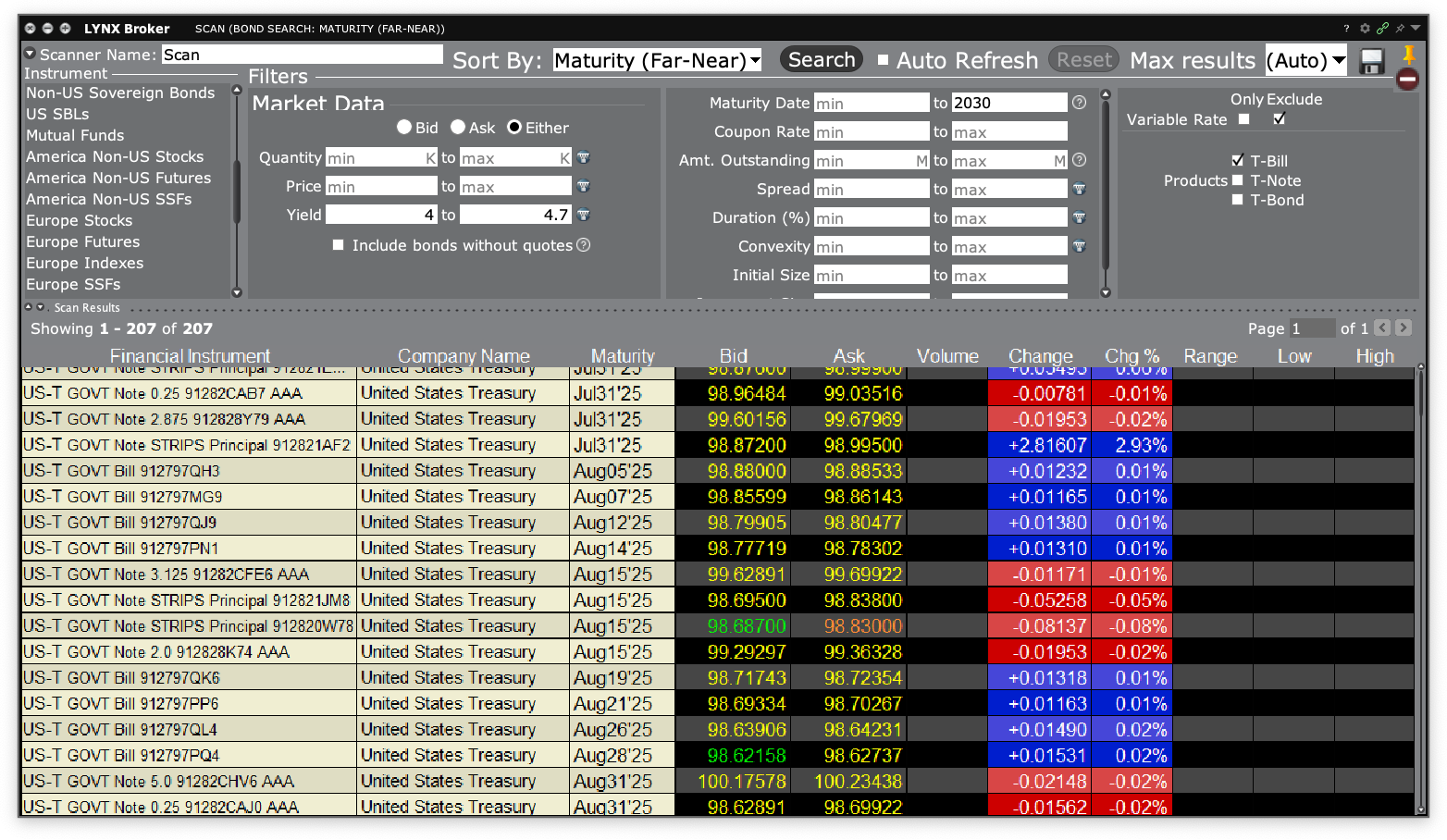

In the Trader Workstation (TWS), you can easily find bonds using the pre-defined Bond Scanner layout. Follow the instructions in the sliders below to add this to your platform and searching your preferred bonds:

How to submit an order

There are several important things to remember before submitting an order:

- Bonds are tradable only via TWS platform and LYNX Trading app.

- Minimum price increment is 1K of the currency of underlying asset but minimum order sizes can vary from 1K up to hundreds of thousands.

- Bonds may be issued in a currency other than the currency of the country from which the bond originates.

- Some bonds may have a very low liquidity at times and your order might be active and be waiting for some time before execution. Market type orders can result in worse fill than expected on low liquidity markets.

- Charts of bonds are based on the bonds’ yield, not its price.

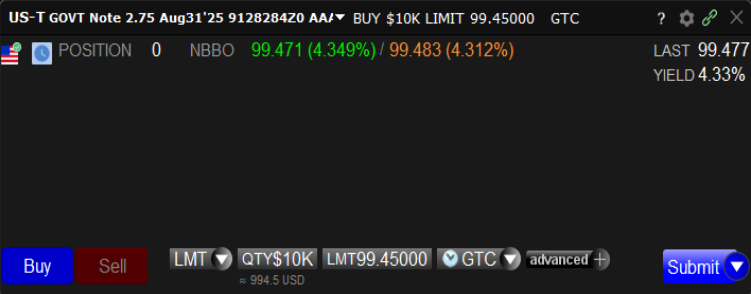

There are several ways to set up an order in the TWS platform. If the investor knows the ISIN (unique identifier), they can add that to a cell in the TWS Watchlist or directly into the TWS Order Entry panel. When using the Bond Scanner you can simply click on selected bond in the Scan Results list which will link the particular bond to the Order Entry window on the right side. In the Order entry window you can specify the details of the order.

- By default, TWS displays the minimum quantity that could be purchased. In the Quantity field you can specify desired amount.

- From the Order Type dropdown menu choose between Limit and Market order types. Certain exchanges to which treasury orders may be routed do not accept Market orders, therefore you can specify a Limit price and entering a maximum price that you are prepared to pay for the bond.

- After clicking Submit, the order confirmation ticket will appear first. Confirm your order by clicking Override and Transmit.

Searching a Bond matching your criteria

Navigate to the Trade tab and use the search bar in the top of the screen to search your desired product. You can find bonds the easiest through the name of the company/country, ticker symbol of the company or ISIN. It is also possible to only enable the category Bonds by clicking the settings icon on the right of the search bar and removing not-needed product categories.

How to submit an order

There are several important things to remember before submitting an order:

- Bonds are tradable only via TWS platform and LYNX Trading app.

- Minimum price increment is 1K of the currency of underlying asset but minimum order sizes can vary from 1K up to hundreds of thousands.

- Bonds may be issued in a currency other than the currency of the country from which the bond originates.

- Some bonds may have a very low liquidity at times and your order might be active and be waiting for some time before execution. Market type orders can result in worse fill than expected on low liquidity markets.

- Charts of bonds are based on the bonds’ yield, not its price.

Once you have selected desired bond, simply click on Buy or Sell button and the Order Ticket page will appear. In the mobile app there are less fields for order specifications than in the TWS platform. In order ticket you can select order details like Face Value, Order type and Price. To submit the order, swipe right over the Slide To Submit Sell/Buy button.

Searching a Bond matching your criteria

It is currently not possible to trade bonds via the webtrader LYNX+.

FAQ

Why didn’t I receive a full coupon?

If you purchase a bond in between coupon periods, the accrued interest is added to the bond’s price at purchase. The seller receives the portion of the coupon they earned before the sale. You will receive the full coupon amount, but part of it may effectively reimburse the seller.

Why is my bond order not being filled?

Bond markets work differently than stock markets. Selling a bond can be challenging due to:

- Closing price mismatch: The displayed closing price might not be tradable and can reflect older or large-size trades.

- Low liquidity: Bonds often trade over-the-counter (OTC), making execution slower and less transparent.

- Indicative quotes: Bid/ask prices are not always firm; they reflect interest, not guaranteed trades.

- Minimum trade sizes: Sometimes only orders above certain face values (e.g. €10,000) are accepted.

Can I sell a bond before the coupon payment has been payed?

Bond interest is paid on a coupon date and reflects interest paid during the coupon period.

- If you sell a bond in the middle of a coupon period, the new owner of the bond will owe you interest for the period you owned the bond.

- If you purchase a bond in the middle of a coupon period, you will owe the previous owner of the bond interest for the period in which you do not own the bond.

Where can I see coupon interest payments and accrued interest?

Coupon payments are made on the scheduled dates defined in the bond’s terms. These are usually semi-annual or annual. If you buy the bond between coupon periods, you will receive the full coupon on the next payment date.

In the Activity Statement you will find interest payments in the sections Interest, Interest Accruals and Bond Interest Paid/Received. More information about the report and its categories, you can find here: Account Statement | Service Center | LYNX Broker