Bracket Order

The strategic one

A Bracket Order is an order type that combines a primary order with two opposite-side orders. These are designed to help investors set predefined levels for taking profit and limiting potential losses.

Learn more about this order type.

What is a Bracket Order?

A Bracket Order consists of three components: a primary order (either buy or sell), a take-profit order, and a stop-loss order. The primary order executes first, while the other two orders are automatically placed in the market to help lock in potential gains or limit losses once the primary order has executed.

Disclaimer

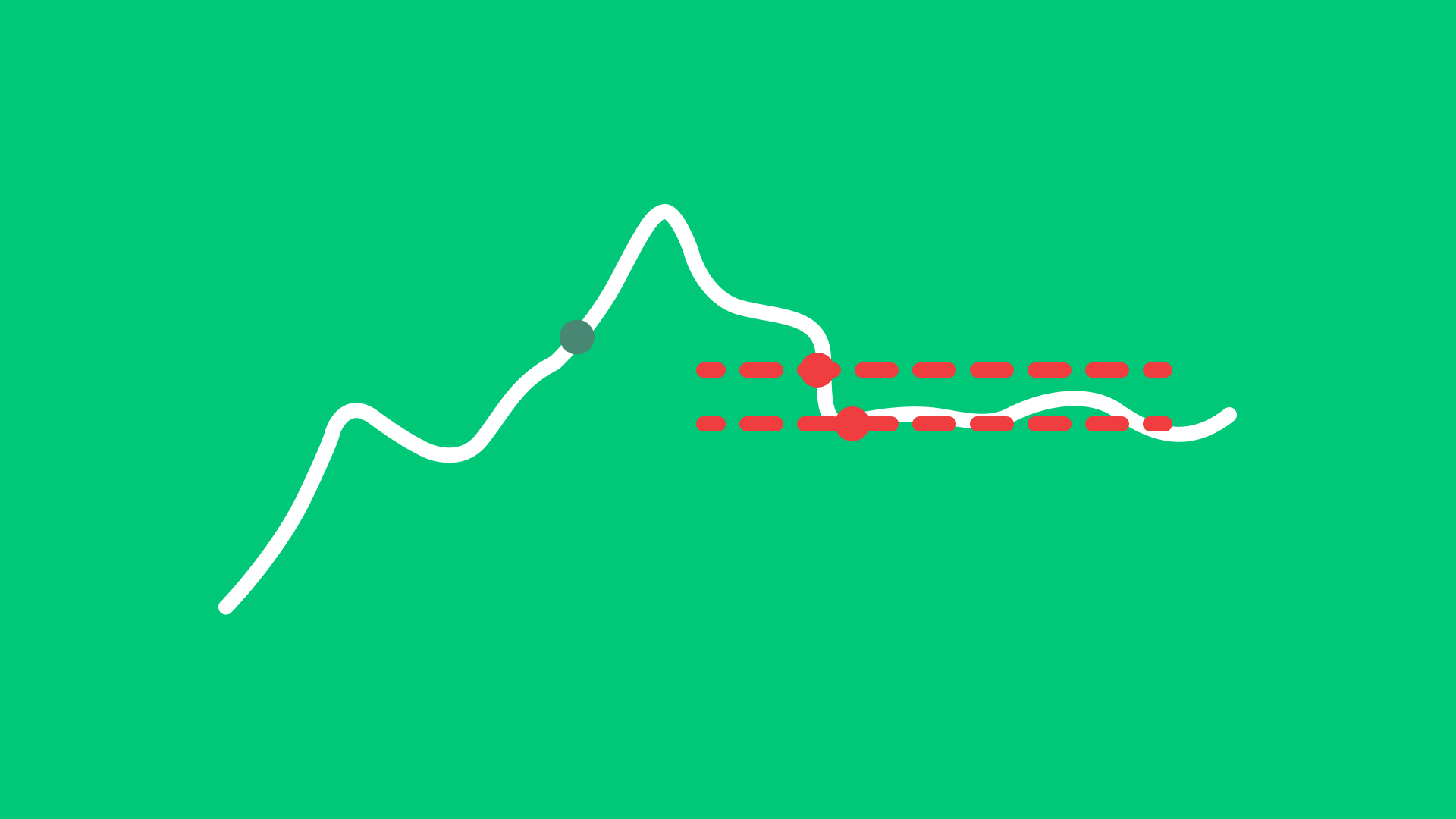

When using a bracket order, both profit-taking and risk-management elements are predefined by setting a take-profit and a stop-loss level. While this provides more control over trade management, execution prices may still differ from the levels entered due to market conditions, such as volatility or low liquidity. Wide price swings or gaps may lead to outcomes different from the levels intended.

Key Features

Three Orders in One

- By combining a primary order with a take-profit and stop-loss order, traders can define their entry and exit points, facilitating a more structured trading approach.

- Once the primary order is executed, the take-profit and stop-loss orders automatically handle the rest, allowing traders to step away from the market without needing constant monitoring.

Predefined Exit Points

- Setting predefined exit points reduces the need for continuous monitoring, as orders are triggered automatically once market conditions meet the set levels.

- These predefined levels can support a more disciplined approach, especially in volatile market conditions.

How does it work?

When placing a bracket order, you’ll need to specify three key components: the primary order, a take-profit order, and a stop-loss order.

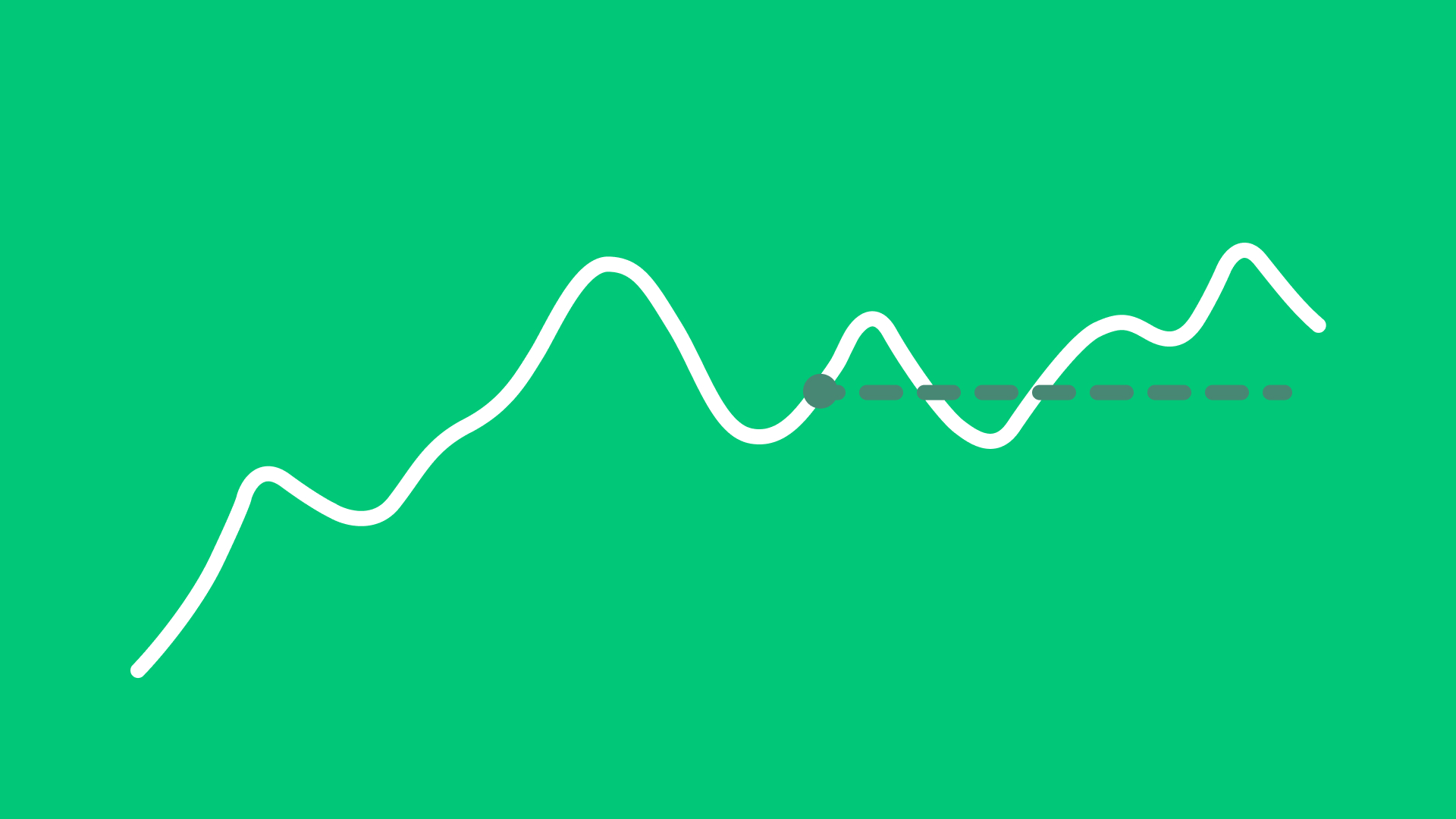

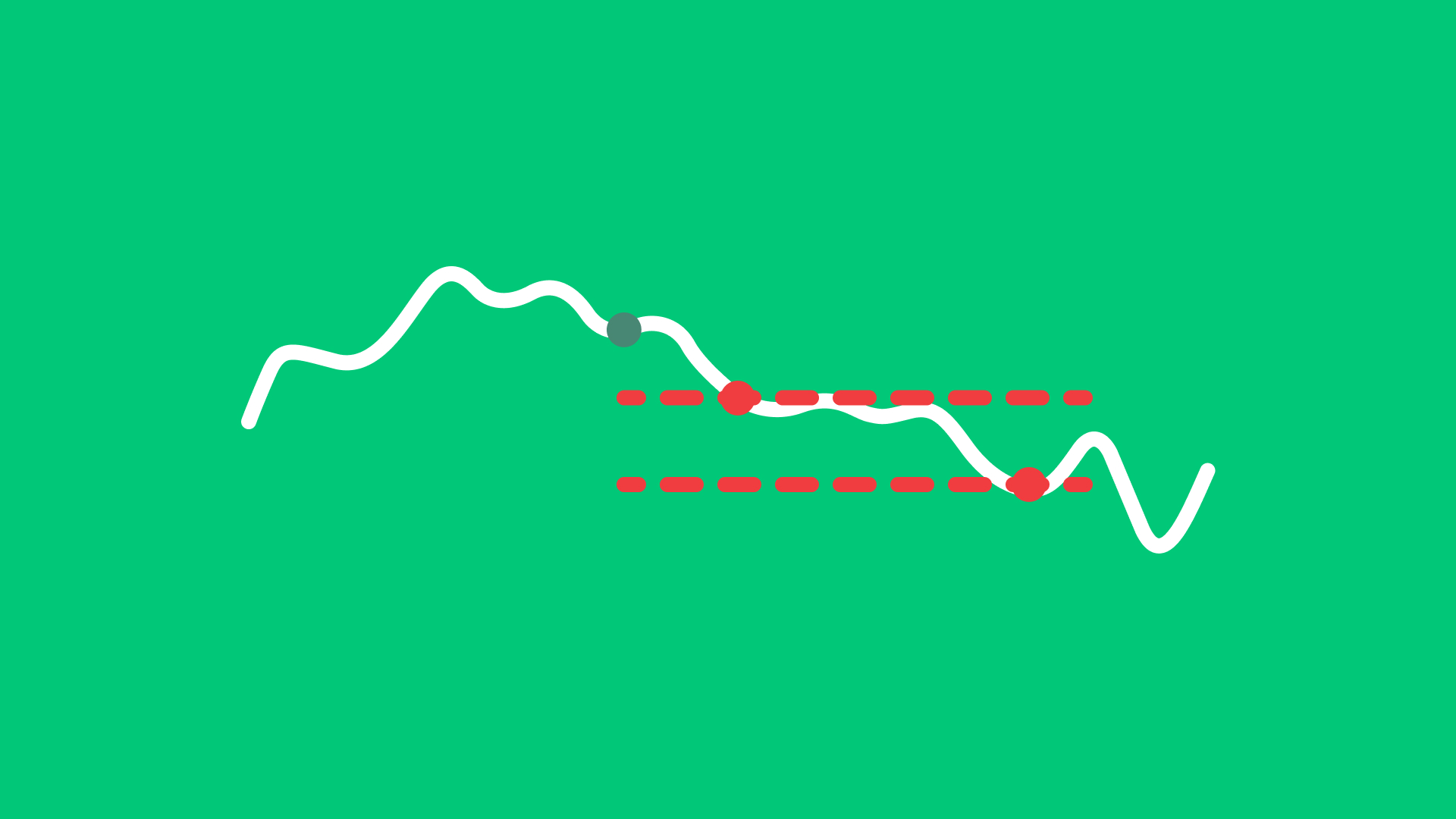

Buy Order

A buy order is accompanied by two sell orders:

- The take-profit is a sell limit order placed above the buy price. It aims to sell the shares for a gain if the price rises.

- The stop-loss is a sell stop order placed below the buy price.

It is intended to reduce potential losses if the price drops.

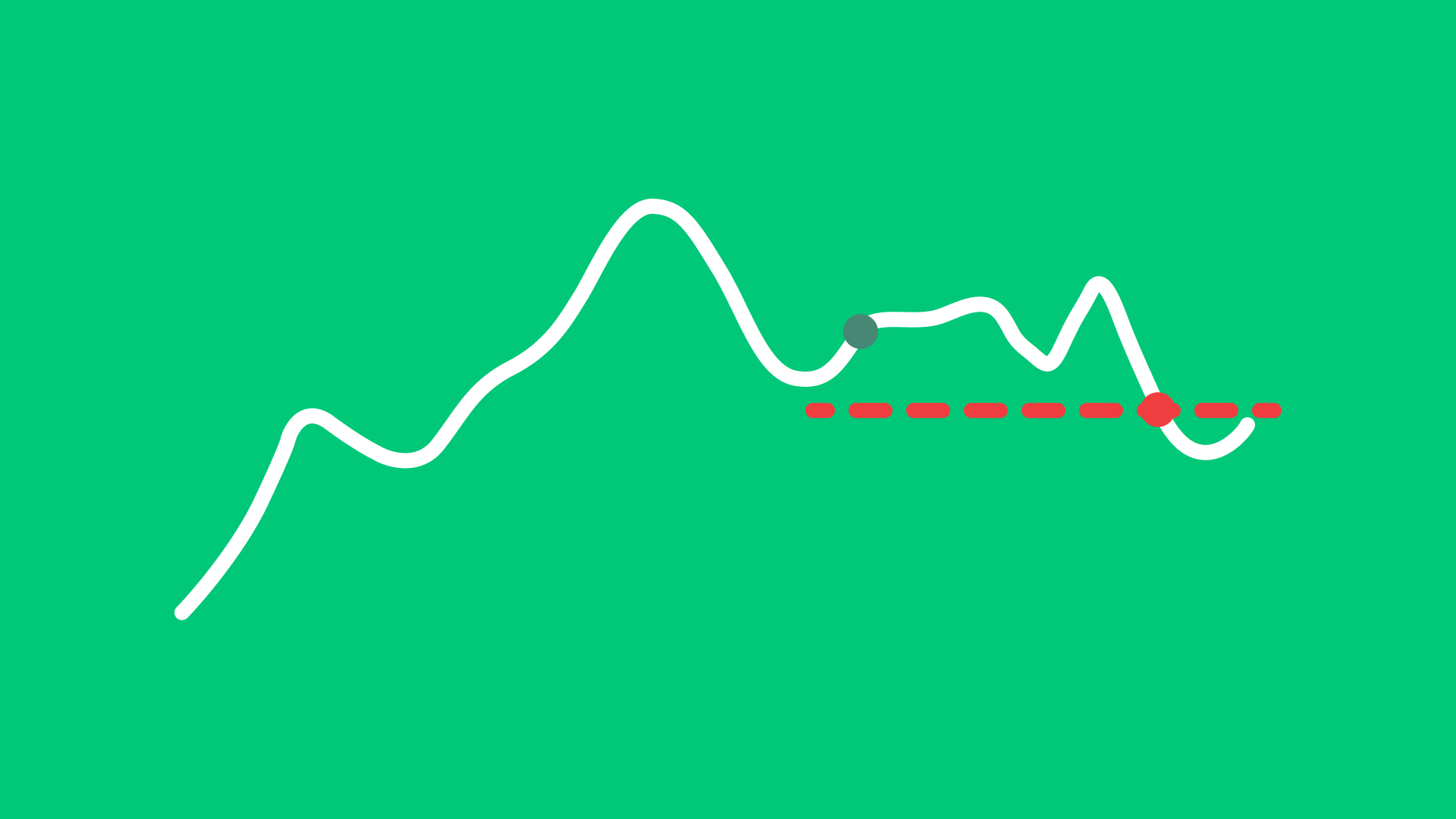

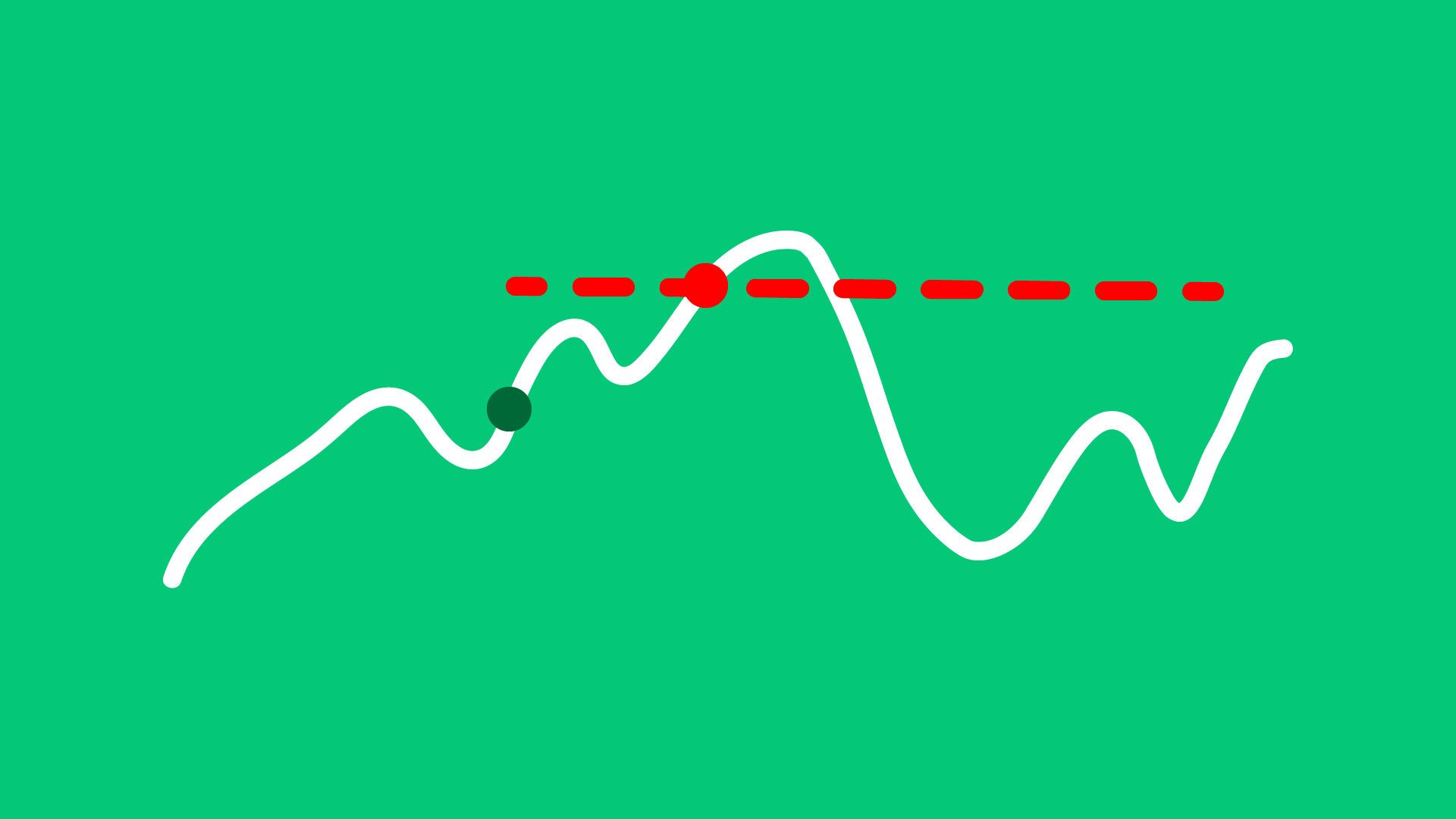

Sell Order

A sell order is accompanied by two buy orders:

- The take-profit is a buy stop order placed below the sell price.

It is designed to repurchase shares at a lower price if the price falls. - The stop-loss is a buy limit order placed above the sell price.

It may trigger a buyback if the price rises unexpectedly, limiting further downside.

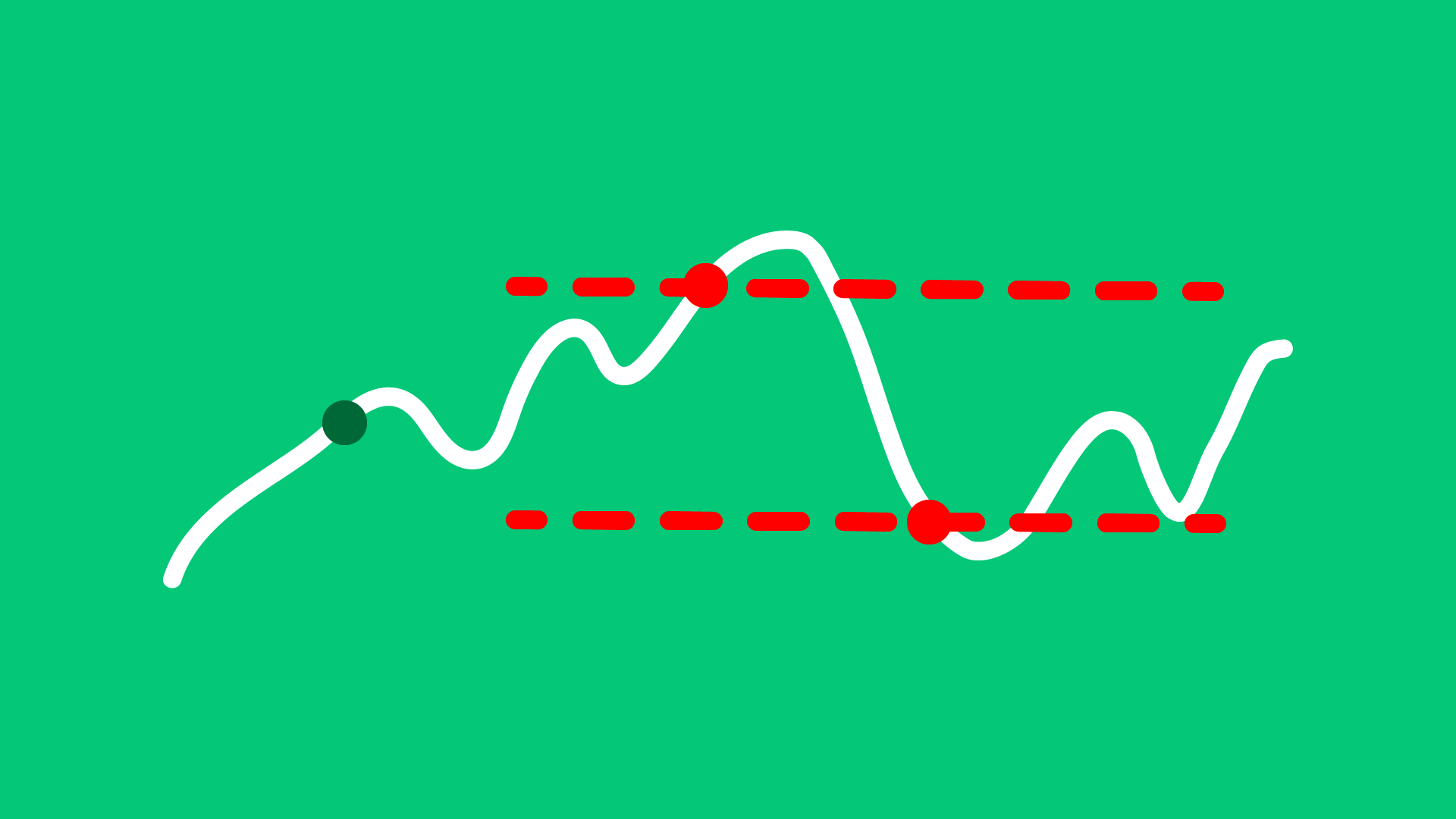

Example:

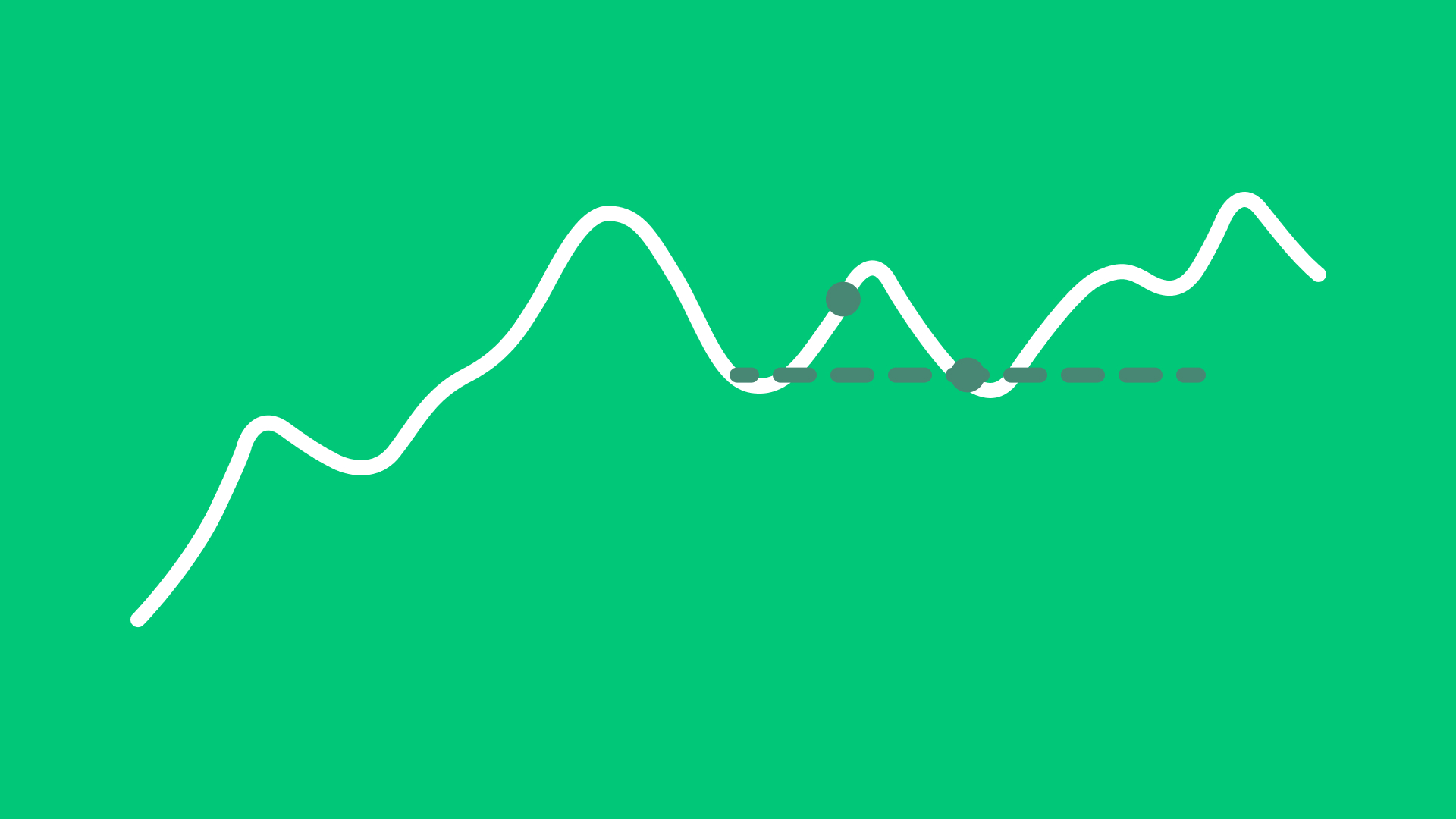

Imagine you wish to buy 100 shares of ABC for 220 EUR. At the same time, you want to set a stop-loss order to sell the shares if the price drops to 215 EUR. You also set a take-profit order in case ABC rises to 230 EUR during the session.

- Scenario 1: The price of ABC rises to 230 EUR. Your attached limit sell order is triggered, and the position is closed at that level, resulting in a realized gain.

- Scenario 2: The price of ABC drops to 215 EUR. Your stop-loss order is triggered, and a sell order executes at that level, limiting the potential loss.

In either case, the remaining untriggered attached order is automatically canceled by the system.

Advantages and disadvantages

Advantages

Disadvantages

- Risk Management:

A Bracket Order helps manage risk by automatically placing take-profit and stop-loss orders, giving predefined exit levels.

- Complexity:

Bracket Orders are more complex than simple market or limit orders, which may be challenging for beginners.

- Automated Execution:

Once the primary order executes, attached orders are submitted automatically, reducing the need for continuous manual monitoring

- Market Conditions:

In volatile or illiquid markets, stop-loss orders may be executed at less favorable prices than intended.

- Flexible Profit Targets:

Investors can set specific price levels for potential profit-taking.

- Partial Fills:

If liquidity is low, attached orders may be executed in parts and at varying prices.

How to attach a Bracket Order to a primary order in LYNX

Login to LYNX+ and search the product you would like to Buy or Sell by ISIN, Name or Ticker.

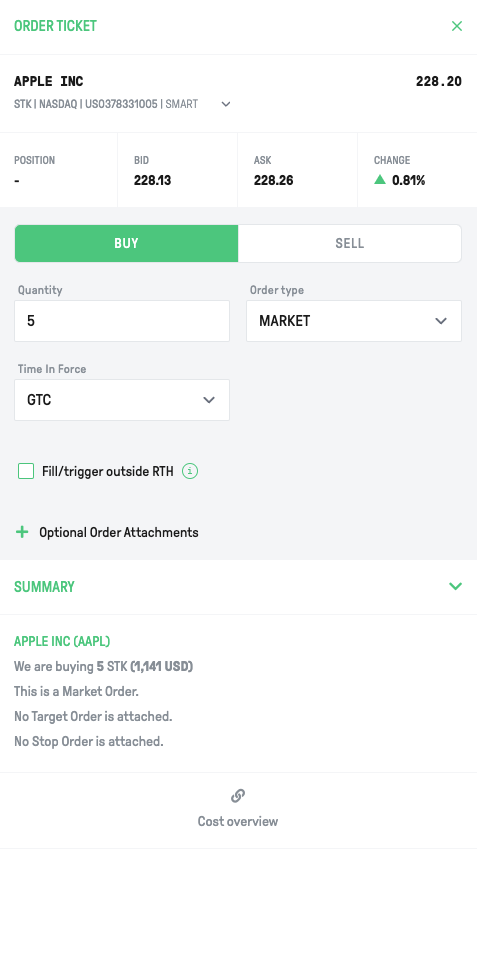

Select the Buy or Sell button in the top-right corner, the order ticket will open on the right side. Here you may define your primary order and to attach a Bracket Order you can decide to add them via the + Optional Order Attachments icon.

After defining your Profit Taker and Stop Loss, you can review the order details in the Summary.

To proceed, click Send Order to submit or Cancel to discard the order.

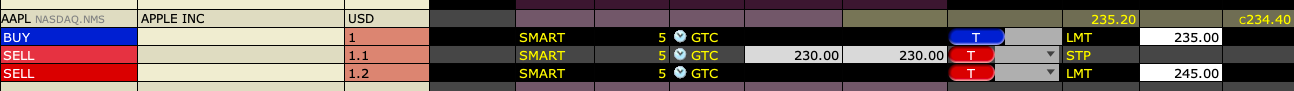

Login to the TWS and open your watchlist.

Create an orderrow by right-click the ticker and select Buy or Sell. After defining this primary order right-click the orderrow and select Attach > Bracket Order.

You can now define the Profit Taker and the Stop Loss by adjusting the limit and the stop prices.

Once done, click on Preview. You can review your order details. To confirm, click on Override and Transmit.

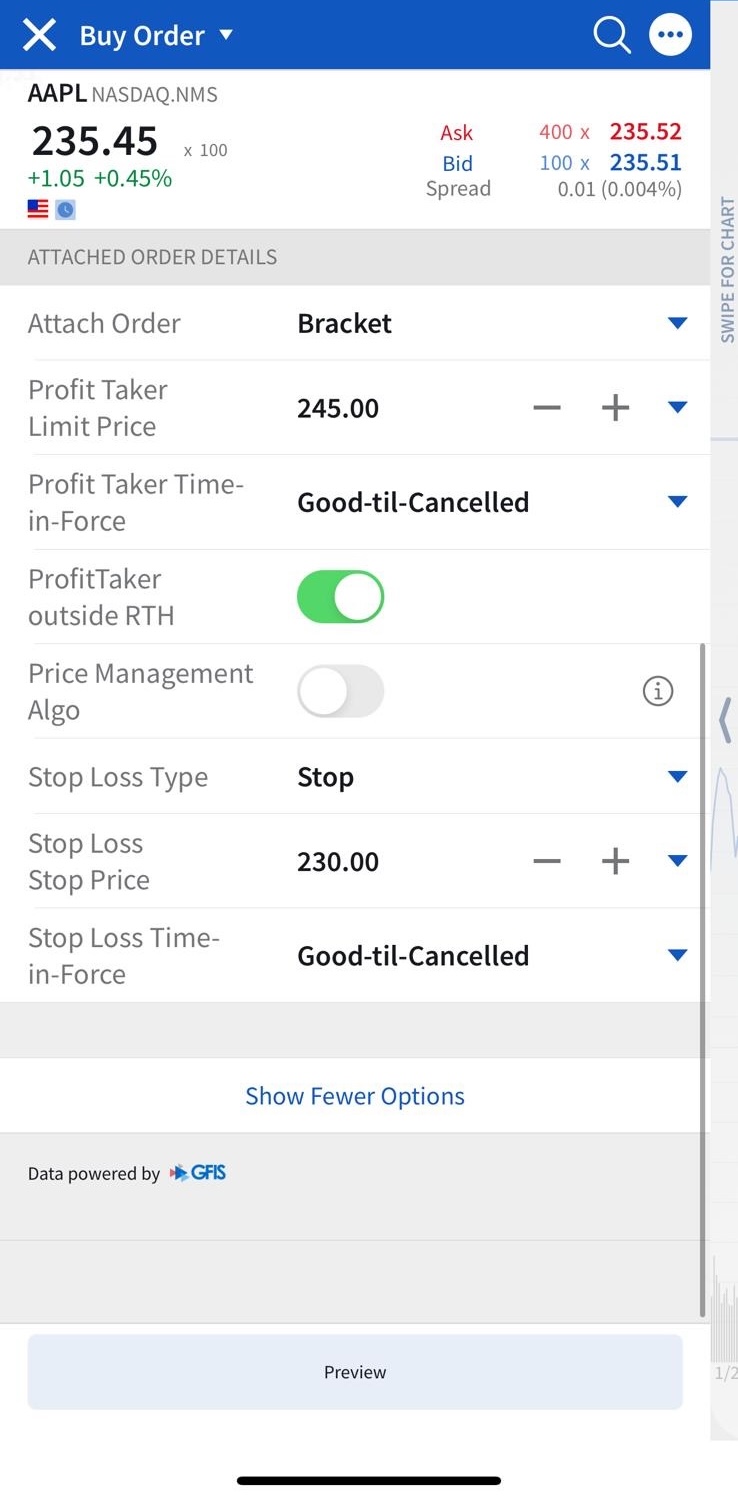

In the app, search the product you wish to Buy or Sell. After clicking on one of these the orderticket will open.

As shown on the media, open the Attach Order part and choose Bracket Order. You can now define the Primary Order, the Profit Taker and the Stop Loss by adjusting the limit and the stop prices.

Once done, click on Preview. You can review your order details.

To submit the order, swipe right over the Slide To Submit button.

Tips before submitting a Bracket Order

When submitting a bracket order, it’s essential to consider several key points to ensure you achieve the best possible execution and minimize potential issues.

When placing a Bracket Order, it is important to consider a few key points to help ensure proper execution and to limit unexpected outcomes.

Appropriate Ordertype

Decide whether to use market or limit orders for your primary order.

Using a limit order can help you control the entry price, while a market order prioritizes immediate execution.

Adjust for Timeframes

Consider the time frame of your trade.

For short-term trades, tighter stop-loss and take-profit levels may be necessary, while longer-term trades might allow for wider margins based on market fluctuations.

Test in Paper Trading

If you’re new to Bracket Orders, practice with a paper trading account first.

This allows you to become familiar with how they work without risking real capital.

FAQ

What types of orders can be included in a bracket order?

A Bracket Order typically includes a market or limit order for entry, a limit order for potential profit-taking, and a stop-loss order to reduce downside risk.

Can I place a bracket order for both long and short positions?

Yes, Bracket Orders can be used for both buy (long) and sell (short) positions. In both cases, they combine a primary order with a profit target and a stop-loss.

When should I consider a bracket order?

A Bracket Order can be considered if you want to predefine both profit and loss exit levels in advance, particularly in markets with high price fluctuations.

How do I set the profit target and stop-loss levels in a bracket order?

You can specify the profit target as a fixed price above the entry level and the stop-loss as a level below the entry. Be aware that market movements may cause execution at different prices than intended.

How to attach a Bracket Order to a current position in TWS?

Right-click on the position you want to create a bracket order for. Select Trade and Create Target/Stop Exit Bracket.

You can now define the Profit Taker and the Stop Loss by adjusting the limit and the stop prices.

Once done, click on Preview. You can review your order details. To confirm, click on Override and Transmit.

How to attach a Bracket Order to a current position in LYNX+?

Login to LYNX+ and click on Portfolio in the top left corner.

Go to Positions and click on the three dots on the right side of the position you would like to submit a bracket order for and select Attach Order. Under Optional Order Attachments, you can enter a Stop Loss and attach a Profit Target.

After customizing the order ticket to your preferences, you can review the order details in the Summary.

To proceed, click Send Order to submit or Cancel to discard the order.

How to attach a Bracket Order to a current position in LYNX Trading App?

Login to the LYNX Trading app and navigate to your Portfolio. Select the position you would like to attach a Bracket Order to.

At the bottom you will see a small pop-up summary about your position. Select the button Exit Strategy and define your Profit Taker and Stop Loss.

Once done, click on Preview. You can review your order details. To submit the order, swipe right over the Slide To Submit button.