Trail Order

The moving one

A trail order is a type of order used to buy or sell a security that continuously adjusts the stop price. Learn more about this order type.

What is a Trail Order?

A trail order is a type of order used to buy or sell a security that continuously adjusts the stop price at a specified offset or percentage below (for a sell) or above (for a buy) the market price as the price fluctuates. When the stop price is reached, the order becomes a market order.

This order type helps investors lock in profits while providing flexibility in adjusting to market movements.

Key Features

Dynamic Adjustment:

A trail order is triggered by a trailing amount, which can be a fixed value or percentage. As the market price moves, the trailing stop price adjusts accordingly.

Market Execution:

Once the trailing stop price is reached, the order becomes a market order, ensuring execution at the next available price.

How does a Trail Order work?

After placing a trail order, the trailing stop price adjusts based on the market price movements.

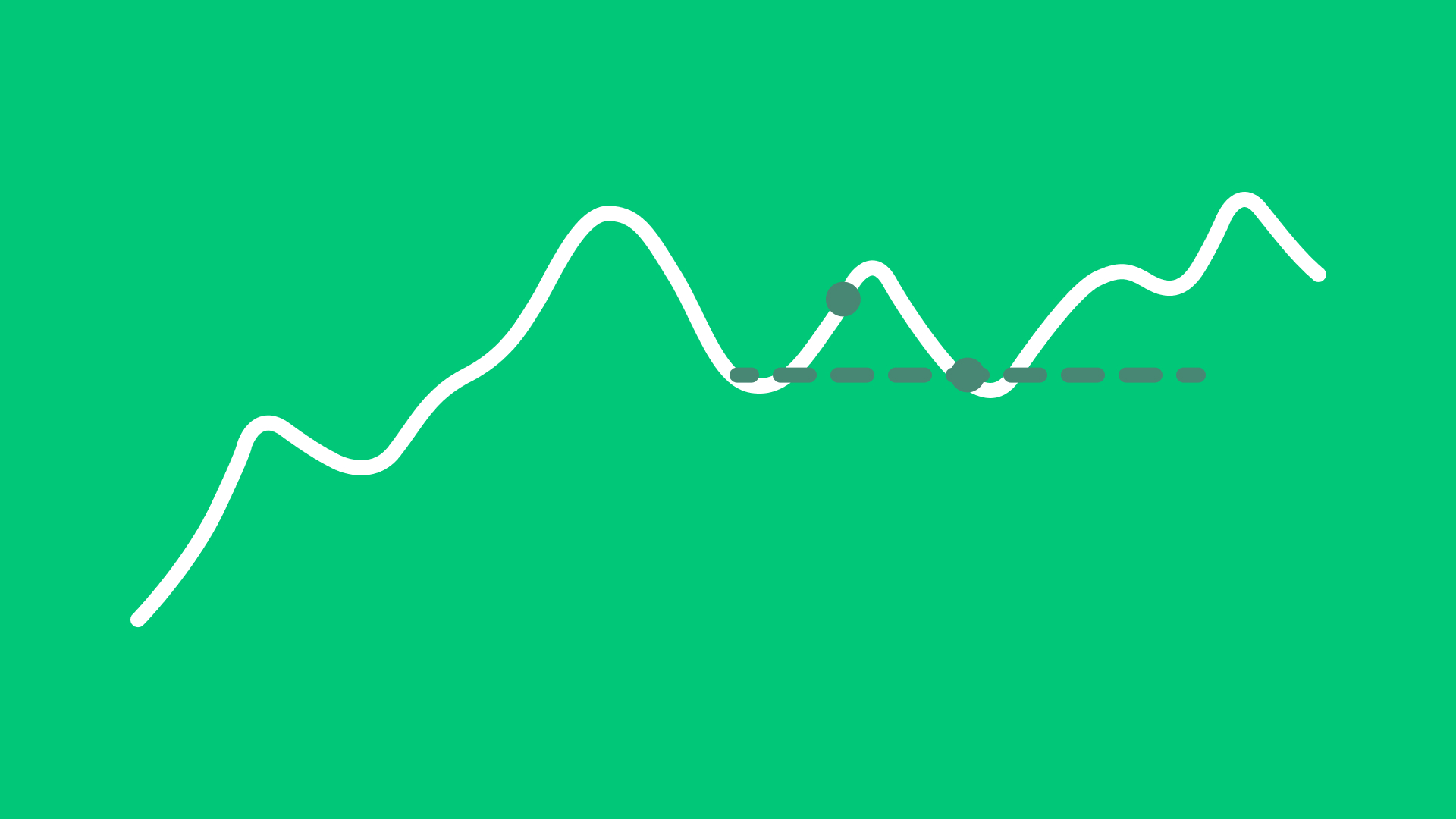

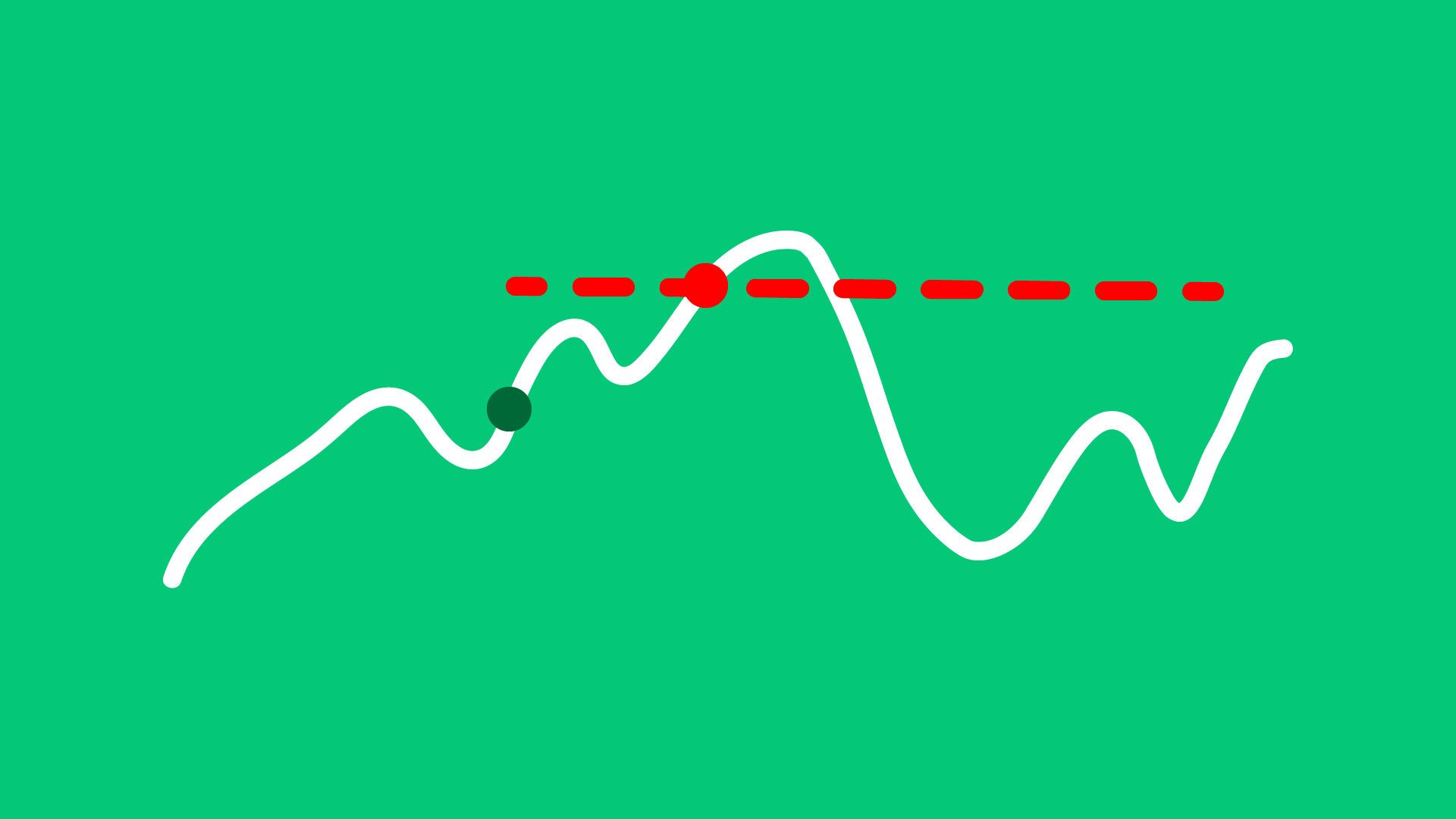

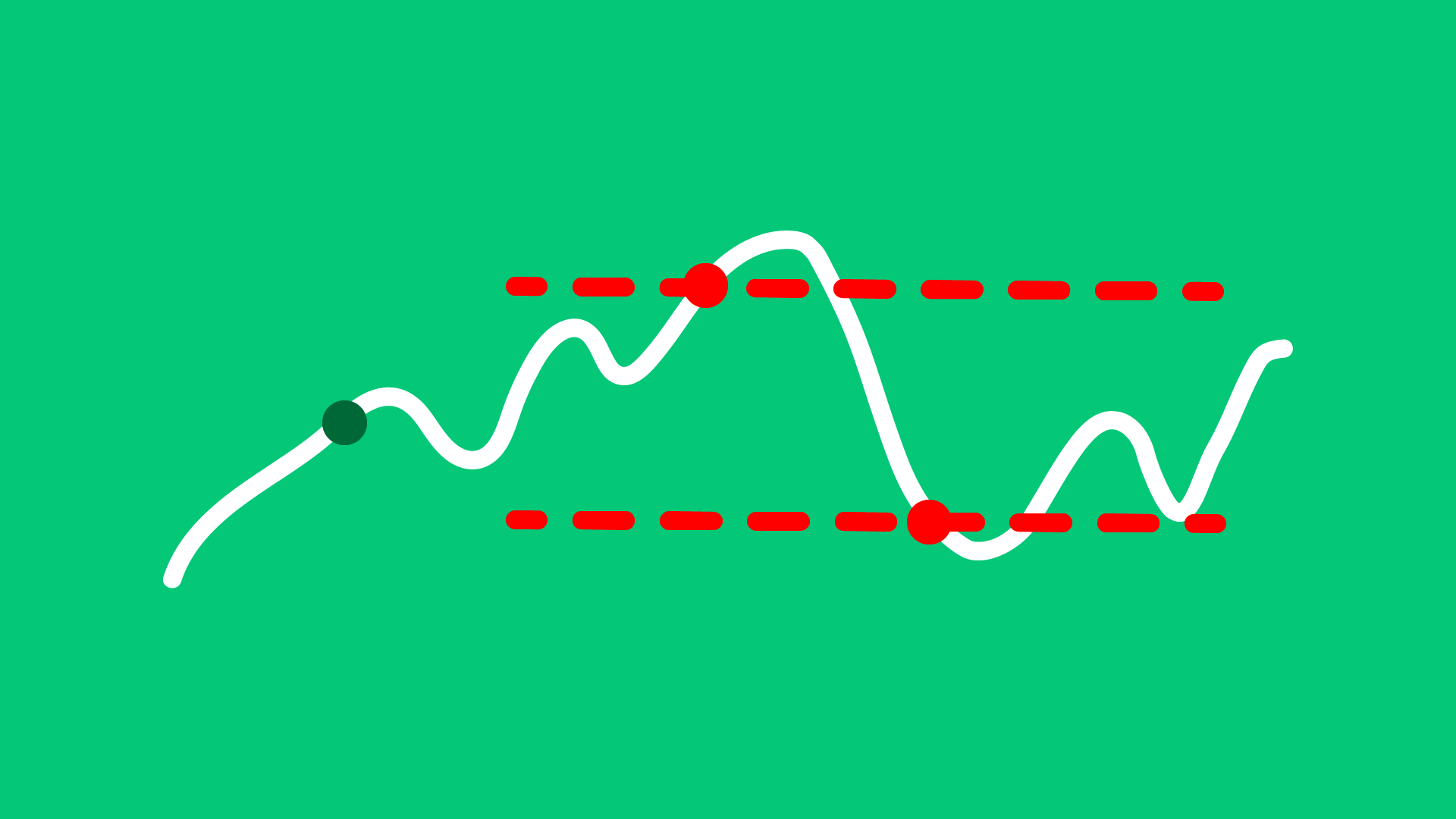

Buy Order

If it’s a buy trail order, the stop price adjusts downward as the market price falls. The market order is triggered when the market price rises by the trailing amount, and it will be executed at the next available price.

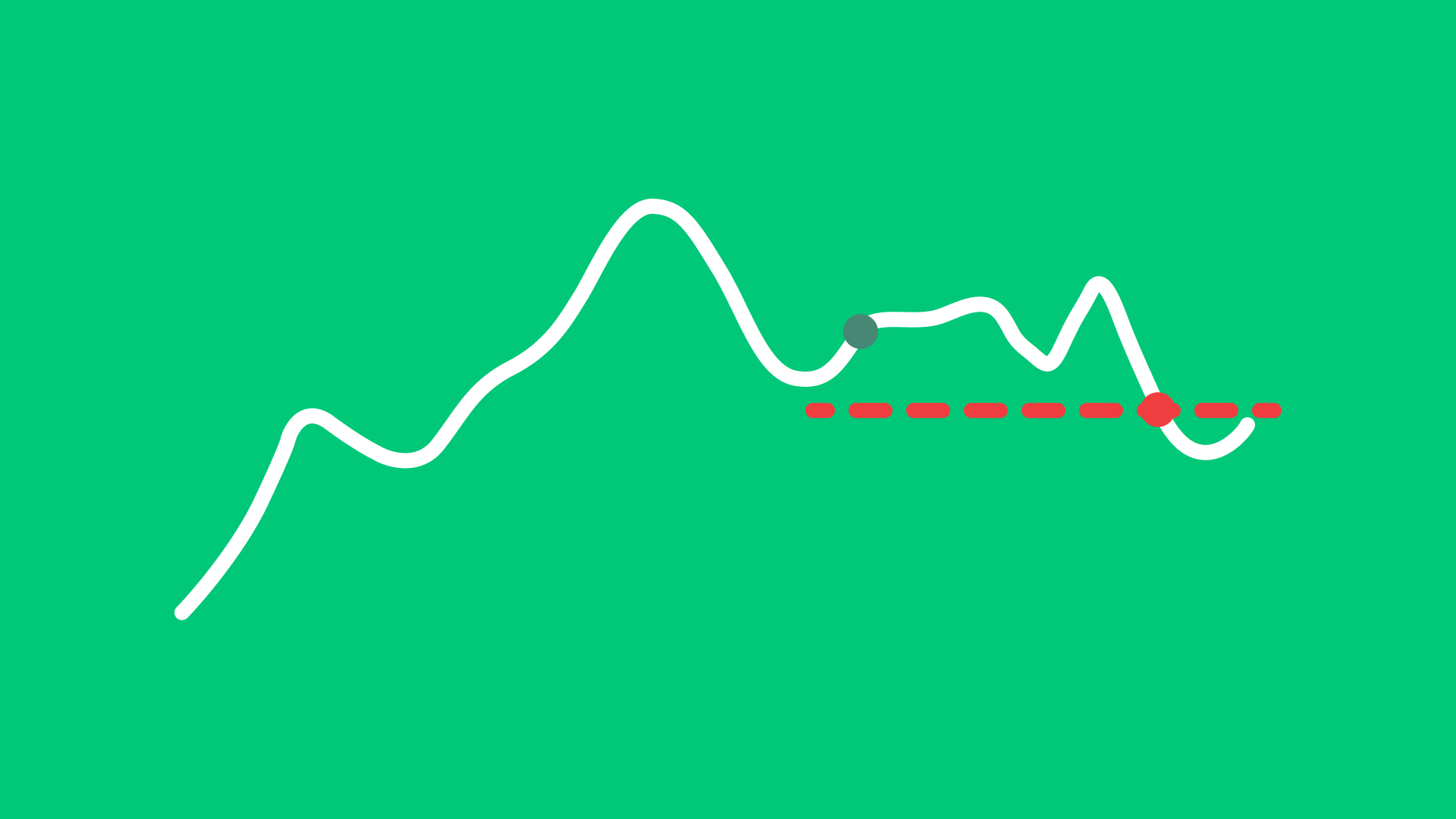

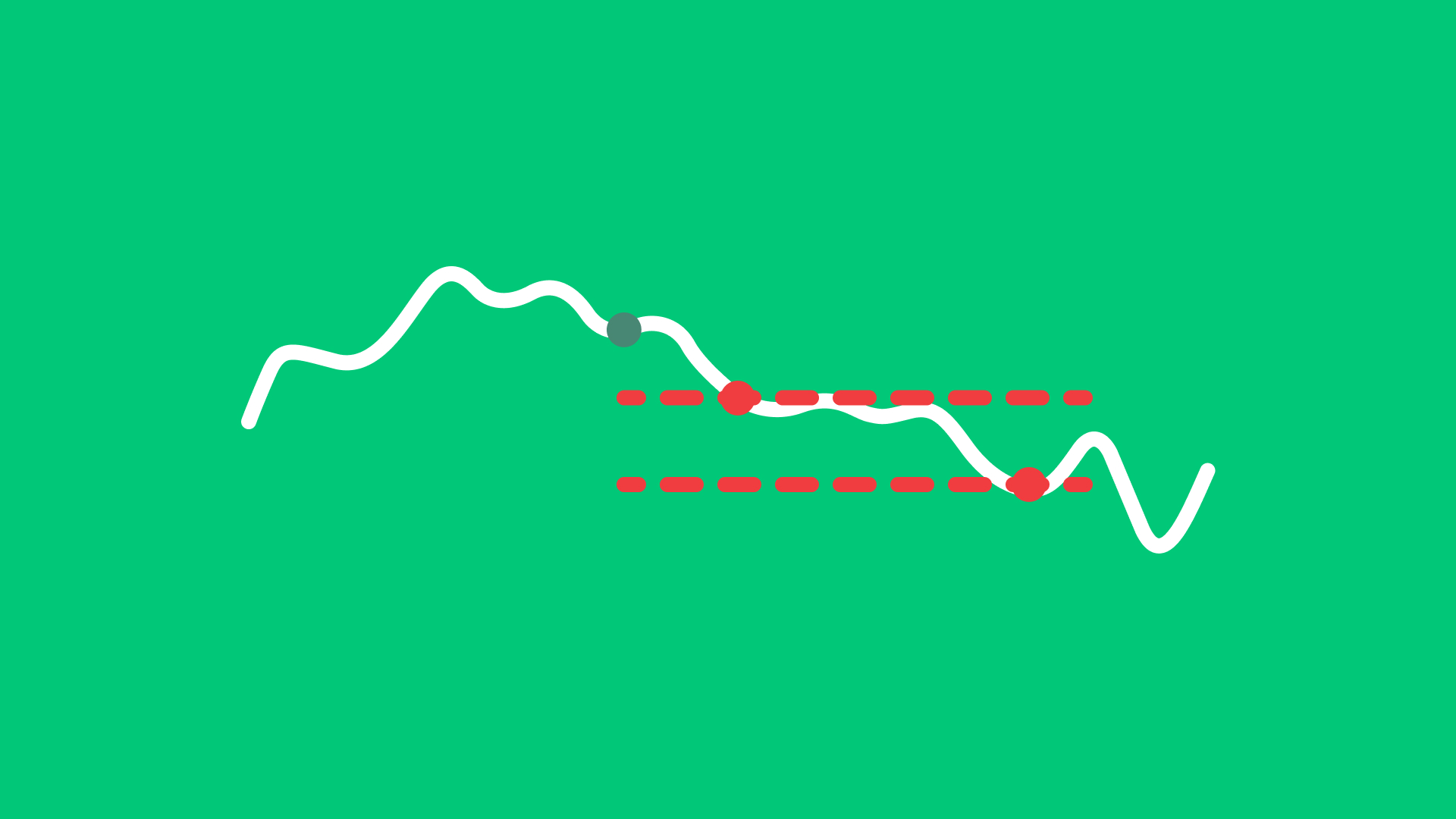

Sell Order

If it’s a sell trail order, the stop price adjusts upward as the market price rises. The market order is triggered when the market price drops by the trailing amount, and it will be executed at the next available price.

The order is executed at the next available price once the trailing stop price is reached, providing flexibility but with potential slippage.

Example:

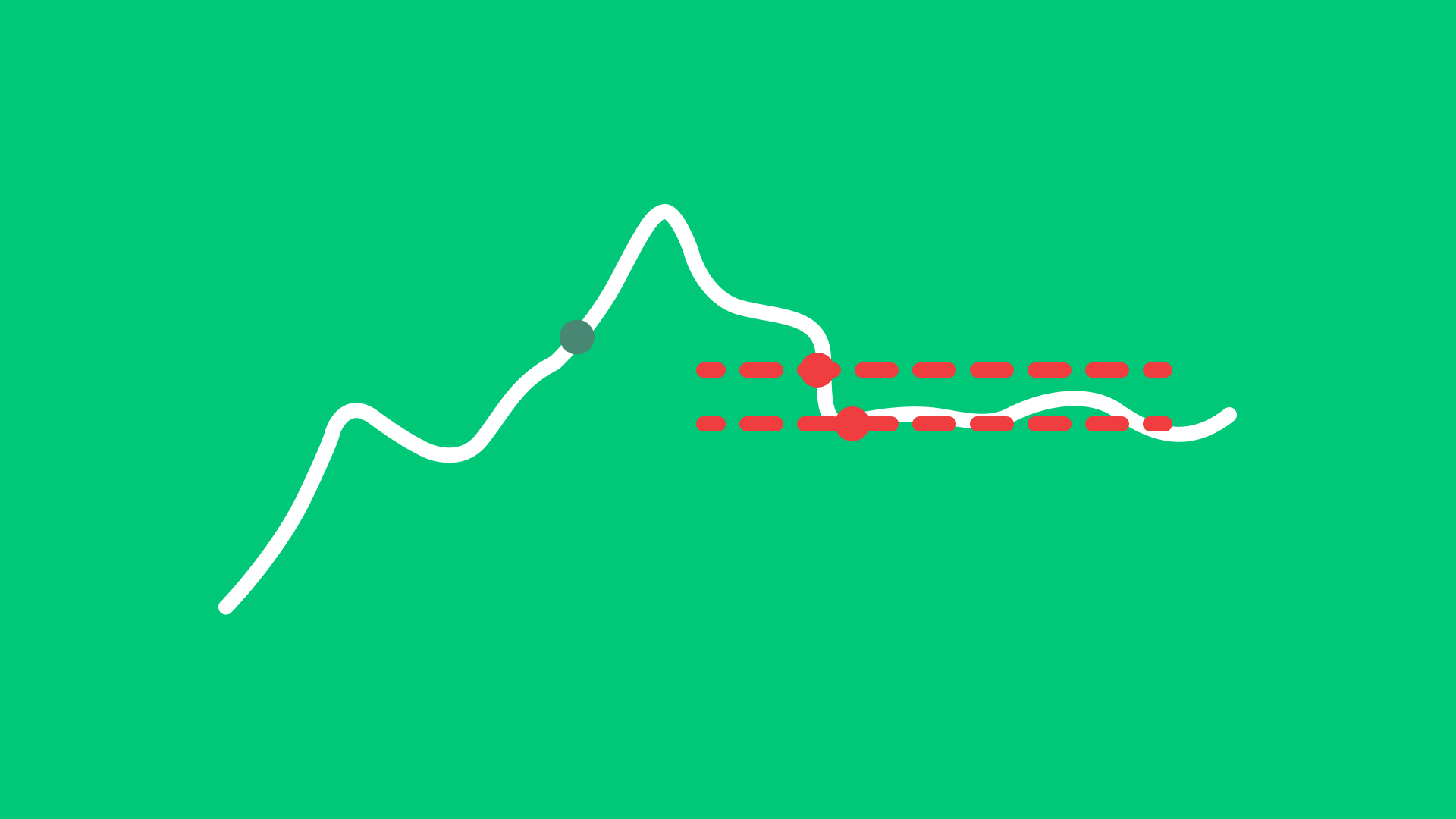

You want to sell 300 shares of XYZ to protect your profits. The shares are currently trading at 20 EUR per share.

You place a trail order with a trailing amount of 1 EUR. If the price rises to 22 EUR, the trailing stop price adjusts to 21 EUR. If the price then drops to 21 EUR, your trail order is triggered and will sell the 300 shares at the next available price, which may be different from 21 EUR.

By selecting this order type, you prioritize flexibility and dynamic adjustment over precise price control. Using a trail order is suitable when you want to lock in profits while allowing for market price adjustments, though it carries the risk of slippage in rapidly moving markets.

Advantages and disadvantages

Advantages

Disadvantages

- Dynamic Price Adjustment:

With a trail order, the trailing stop price adjusts with market movements, allowing for potential gains while protecting against losses.

- Lack of Price Control:

Once the trailing stop price is triggered, the order becomes a market order, which can result in execution at less favorable prices, especially in volatile markets.

- Ease of Use:

Once set, trail orders are executed automatically when the trailing stop price is reached, reducing the need for constant market monitoring and saving time and effort.

- Potential for Slippage:

Slippage refers to the discrepancy between the expected price of a trade and the actual price at which it is executed. This often occurs with trail orders, especially in volatile or illiquid markets.

- Loss Limitation:

Trail orders can limit potential losses by dynamically adjusting the stop price, providing a structured exit strategy.

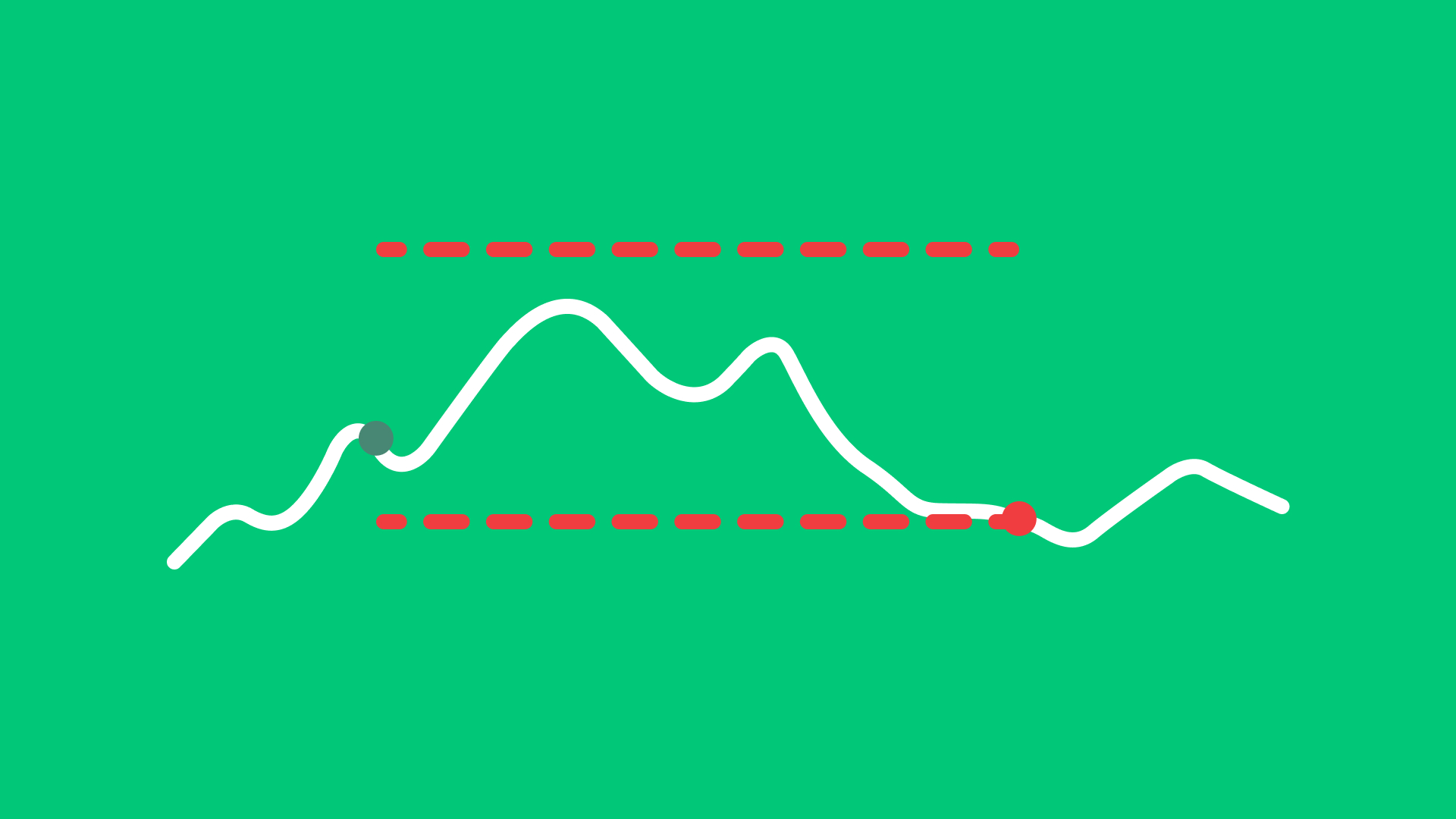

- Short-term Fluctuation Risk:

Trail orders can be activated by brief price fluctuations or “spikes,” potentially leading to premature exits before a potential reversal occurs.

Submitting a Trail Order via LYNX

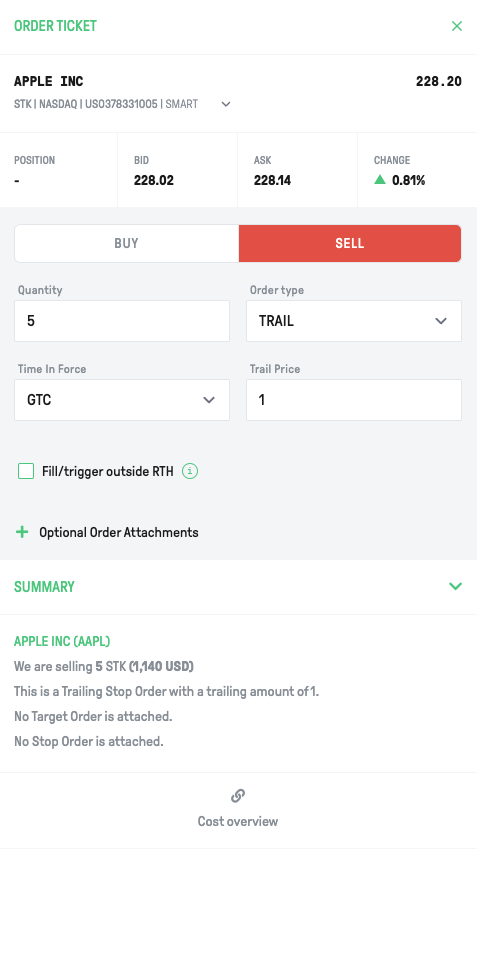

In LYNX+, you can find specific securities using the search bar located in the top right corner. You can search by the name, ISIN code, or specific ticker of the product.

Once you have selected the product you want to trade, you will be taken to the product overview. Here, in the top right corner, you can click on Buy or Sell if you wish to trade this stock immediately. Specify the quantity and select the time in force for your order.

Select either TRAIL or TRAIL % from the Order Type dropdown menu. TRAIL adjusts the stop price by a fixed amount, while TRAIL % adjusts it by a percentage.

After customizing the order ticket to your preferences, you can review the order details in the Summary.

To proceed, click Send Order to submit or Cancel to discard the order.

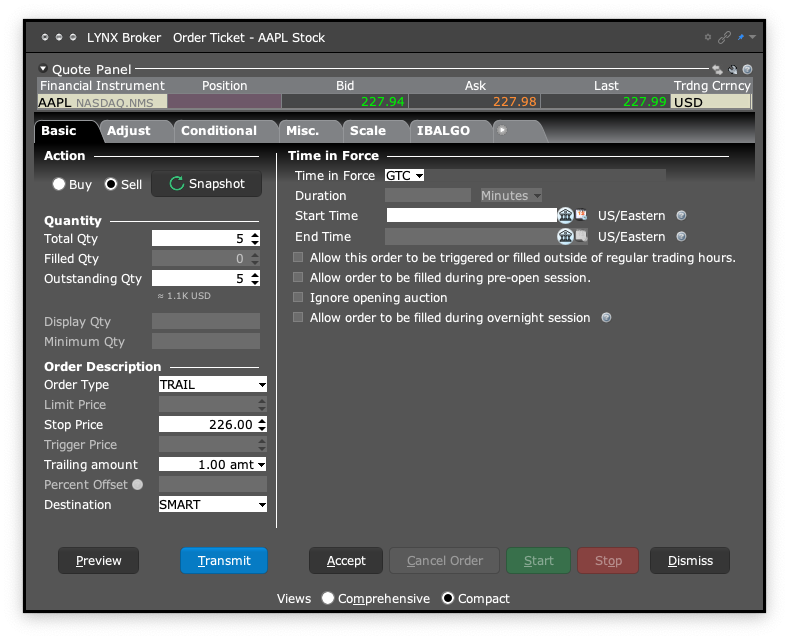

After logging into TWS, open the order ticket by clicking Order in the top left. If you have a certain security selected, it will automatically open an order ticket for that security. You can change the underlying by typing the name, ticker code, or ISIN in the Financial Instrument column at the top of the order ticket.

Choose the action (buy or sell), specify the quantity, the destination, and select the time in force for your order.

Select TRAIL from the Order Type dropdown menu.

In the bottom left of the order ticket window, you can press Preview to look at the summary of your order. Then click on Transmit to submit the order or on Close to close the preview.

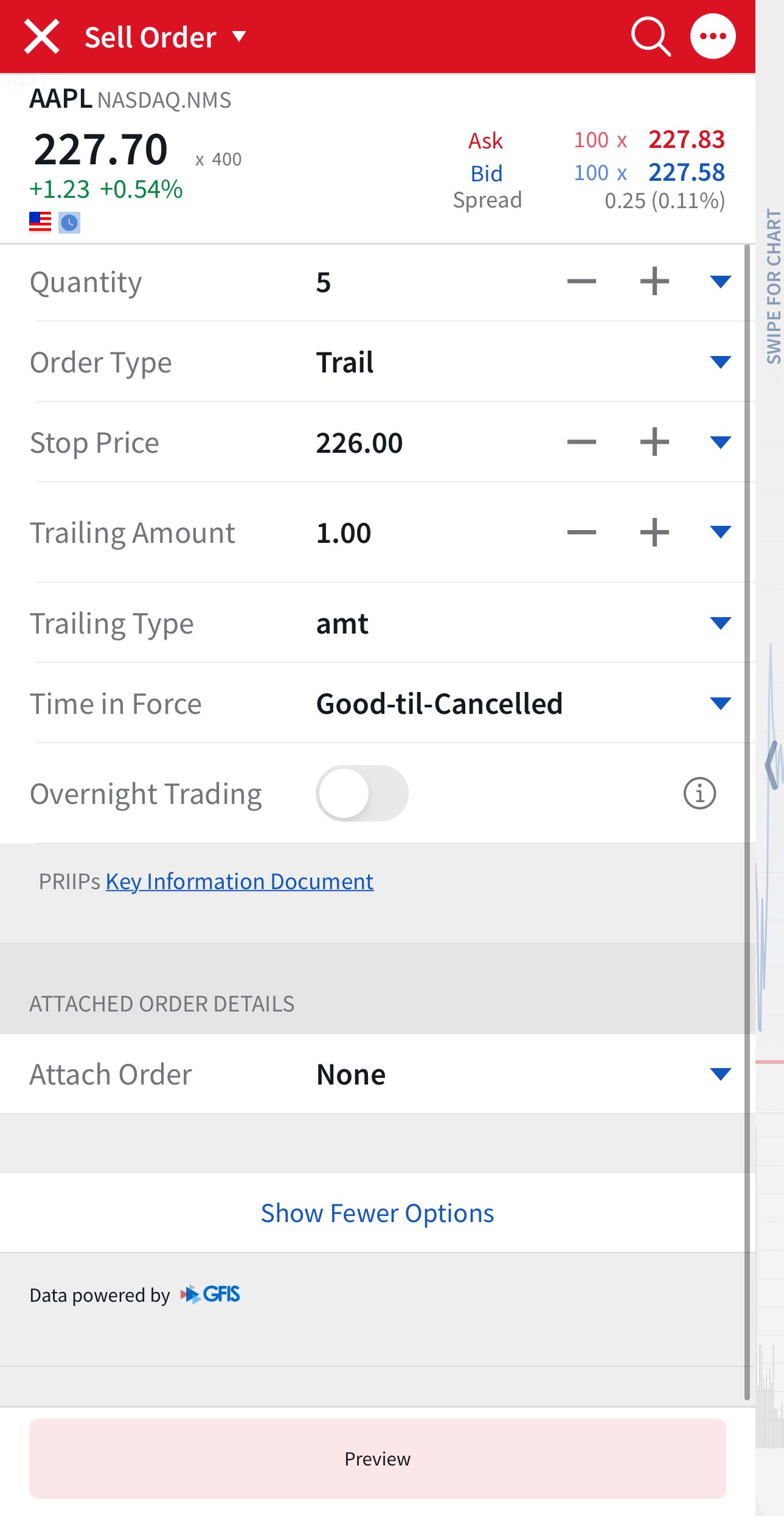

To search for a product, tap the Search icon in the top right. Enter the name, ISIN, or ticker symbol. Tap a search result to open the product’s page.

By clicking on Sell or Buy, you will access the order ticket.

Specify the quantity and set the validity period of your order under Time in Force. Select TRAIL as an order type.

Before submitting the order, you can check the parameters of your order via the Preview/Calculator icon on the bottom right. To submit the order, swipe right over the Slide To Submit Sell/Buy button.

Tips before submitting a Trail Order

When submitting a trail order, consider several key points to achieve the best possible execution and minimize potential issues.

Liquidity

Ensure the asset you are trading has sufficient liquidity.

Higher liquidity generally means tighter bid-ask spreads and less impact on the market price when executing a trail order.

Timing

Trail orders are best placed during regular trading hours when liquidity is highest. Placing orders outside of these hours can result in poor execution prices.

Also, avoid placing trail orders during major economic announcements or earnings reports, as these events can cause rapid price fluctuations.

In highly liquid markets, large orders may be filled in multiple parts, possibly at different prices.

Monitoring

The bid-ask spread is the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept.

A wider spread can result in higher costs for executing a trail order. Monitor the spread and consider its impact on your trade.

You should set your trailing amount with enough distance from the stop price to account for market fluctuations before placing the order. This helps prevent the order from being triggered prematurely due to minor price movements.

FAQ

With Stocks IB only allows Limit, Trail Limit and Stop Limit order types to be active that are configured to work in the Pre-Market and After-Market trading hour sessions. Market, Stop and Trail orders will only work during the Regular Trading Hours depending on the exchange.

For Derivates it could differ, please check the following page (Outside Regular Tradinghours ) to see if other order types are suitable outside regular trading hours.

If you wish to limit your losses in a particular product, you can place a stop or trail order. Once the price of a stock reaches your stop price (this is called triggering an order), a MKT order is then sent to the exchange to buy or sell (depending on whether you hold a long or short position). The difference between a stop and a trail order is the dynamic adjustment of the stop price. Once triggered, the order cannot be modified or removed.

With a stop order, a market order is generated, indicating that you wish to buy or sell a predetermined number of pieces at the best current price. With a trail order, the stop price adjusts dynamically with the market price movements, becoming a market order once the trailing stop price is reached.

Trail orders are best used when you want to protect against significant losses or secure profits on a position while allowing for dynamic price adjustments. They are ideal in markets where price protection and dynamic adjustments are more important than precise execution control.

Before placing a trail order, consider the current market conditions, potential price volatility, and your willingness to accept the market price once the trailing stop price is hit. Assessing these factors can help you decide whether a trail order is the best choice for your trade.

Yes, you can cancel a trail order any time before it is triggered. Once the trailing stop price is reached and the order becomes a market order, it is typically executed almost immediately, making it difficult to cancel.

Depending on the trading platform, you can check the current stop price as follows:

- In LYNX+, go to Portfolio and then Open Orders. You can see the current stop price above the trailing amount in grey between brackets.

- In TWS, look under Pending (All). The current stop price will be displayed in the Stop Price column.

- In the LYNX Trading App, check under Orders.