Limit Order

The classic one

A limit order is one of the main order types and is widely used to buy or sell a financial asset. Learn more about this order type.

What is a Limit Order?

A limit order is one of the main order types and is widely used to buy or sell a financial asset at a designated price or better. The order will only be executed if the market price reaches the specified limit price.

A limit order allows investors to specify the maximum price they are willing to pay when buying or the minimum price they are willing to accept when selling. They allow investors to set precise entry and exit points for their trades, which could be, for example, useful in volatile markets or when specific price targets are desired.

The downside of a limit order is that it may not be executed immediately or at all if the market price does not reach the specified limit price. Additionally, if there is insufficient trading volume at the limit price, the order may only be partially filled.

Key Features

Price Control

A limit order allows you to specify the maximum price at which you are willing to buy or the minimum price at which you are willing to sell a security. This allows traders to manage the price at which their transactions occur, offering them more discretion over their investment outcomes.

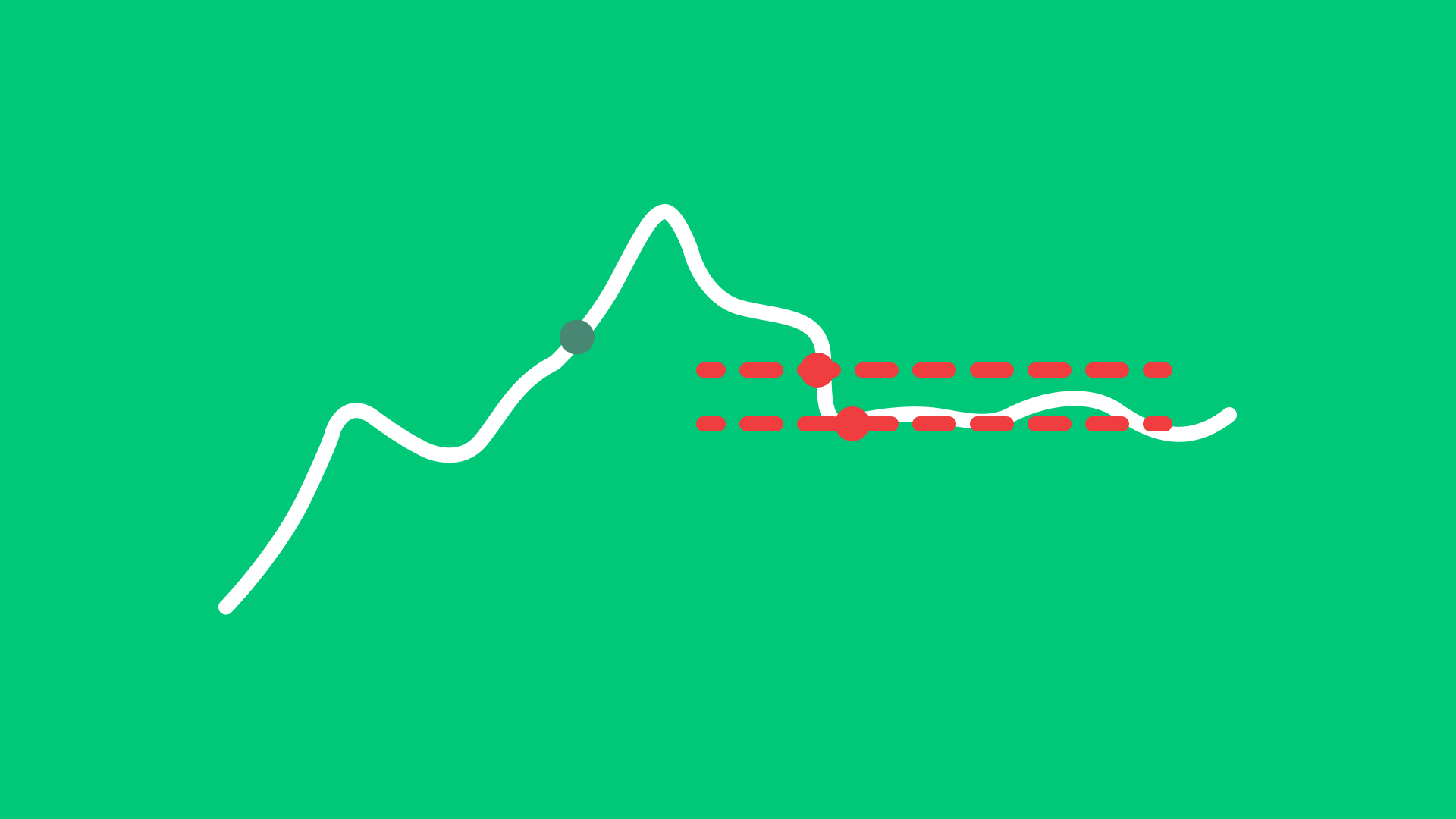

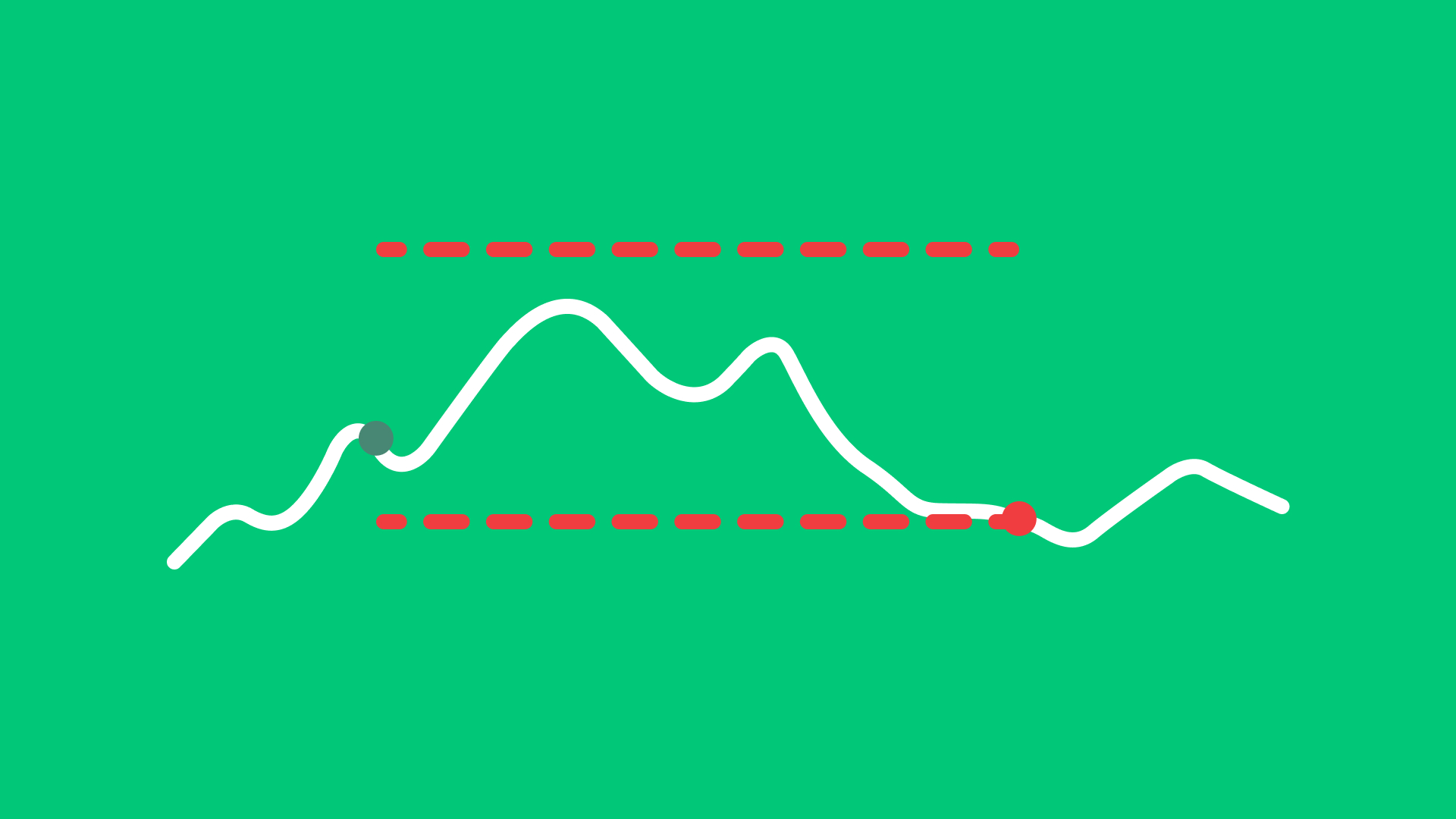

Non-Execution Potential

There is a risk that a limit order may not be executed if the market does not reach your specified limit price. This risk means that your order could remain unfilled, especially in a volatile market. Additionally, if there is insufficient trading volume at your limit price, the order may only be partially filled. This potential for non-execution requires traders to carefully consider their price limits and the current market conditions when placing limit orders.

How does a Limit Order work?

A Limit Order works by allowing you to specify the exact price at which you want to buy or sell an asset.

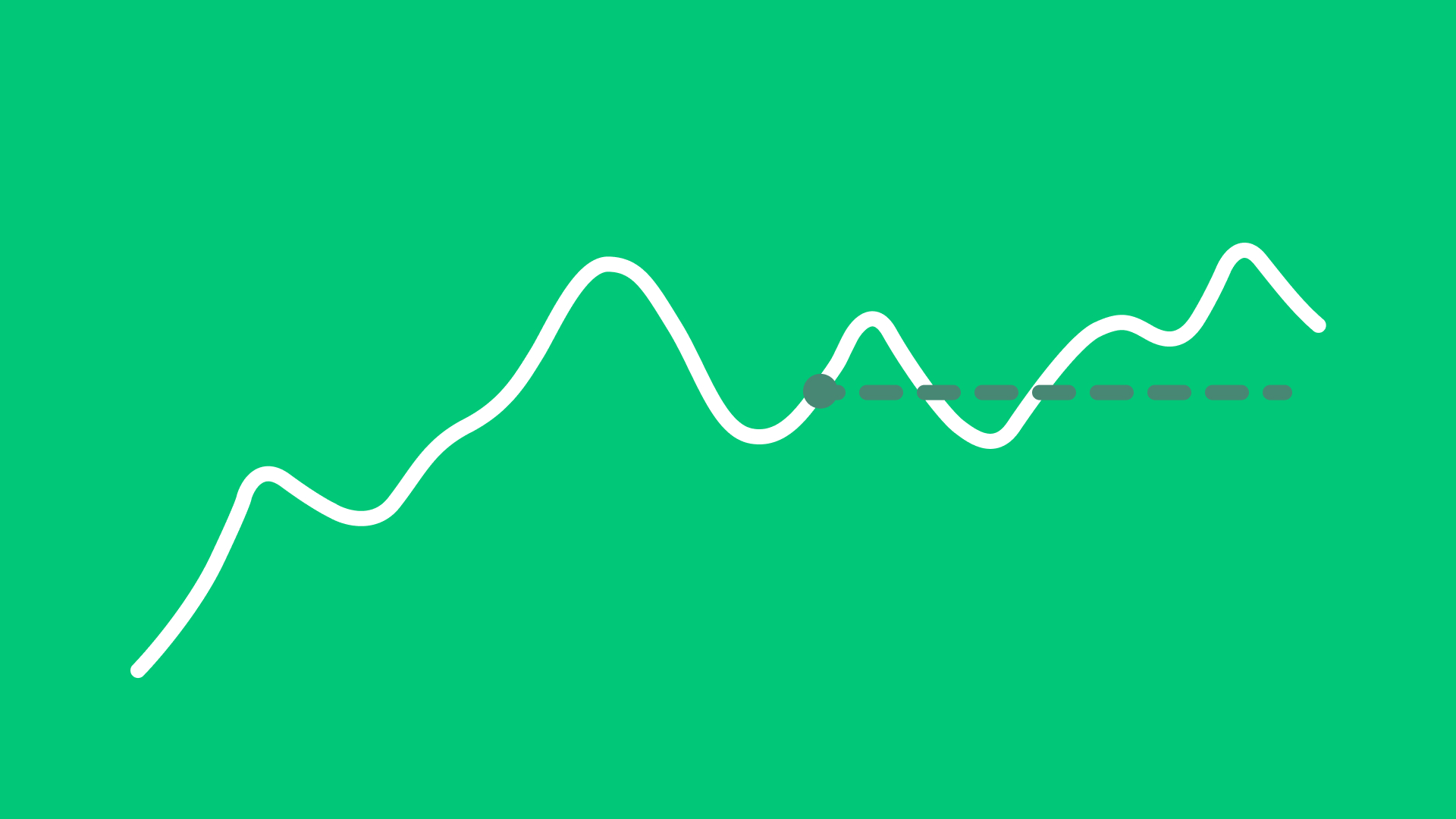

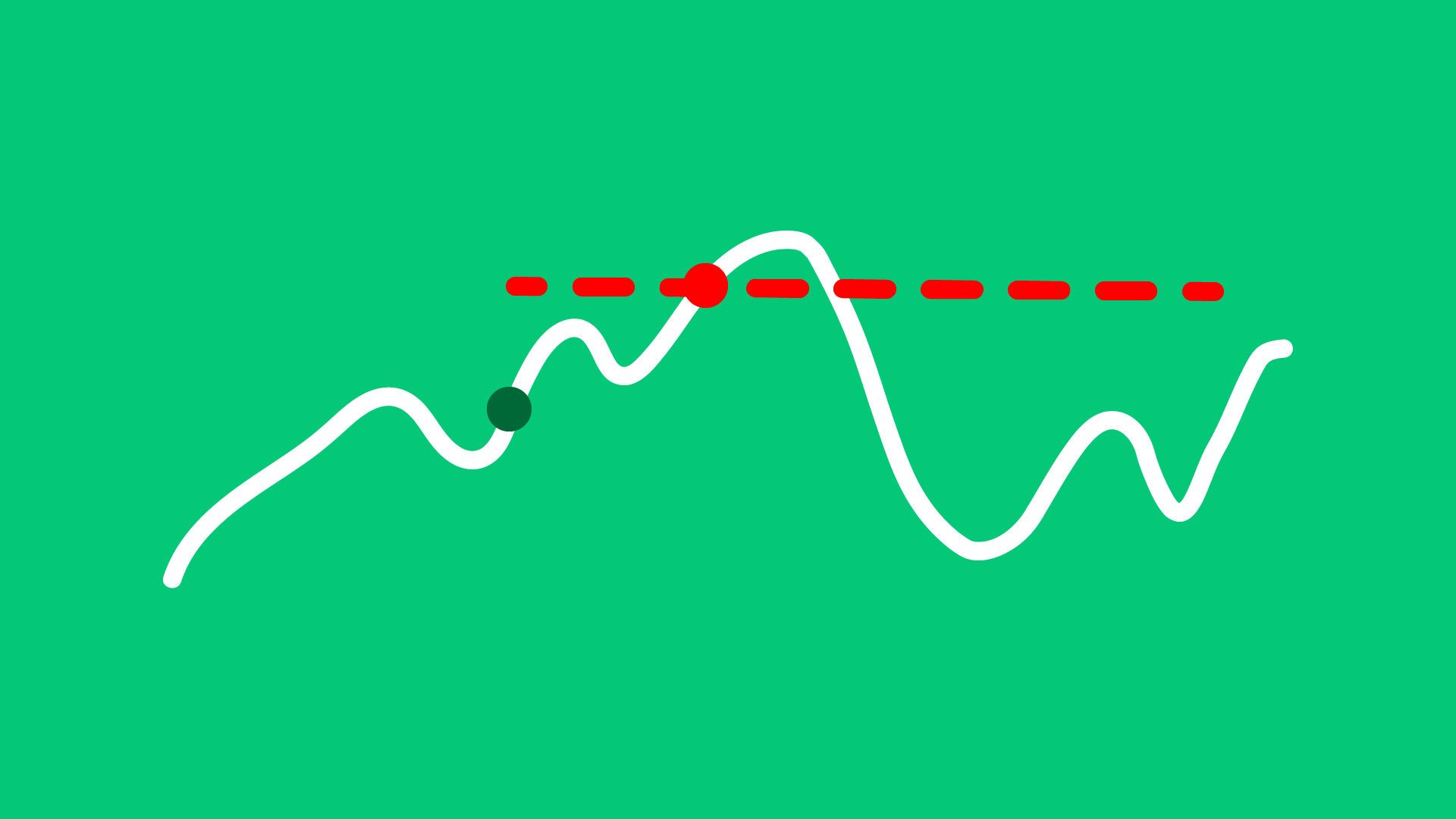

Buy Order

You specify the maximum price you are willing to pay. The order will only be executed at your specified limit price or lower.

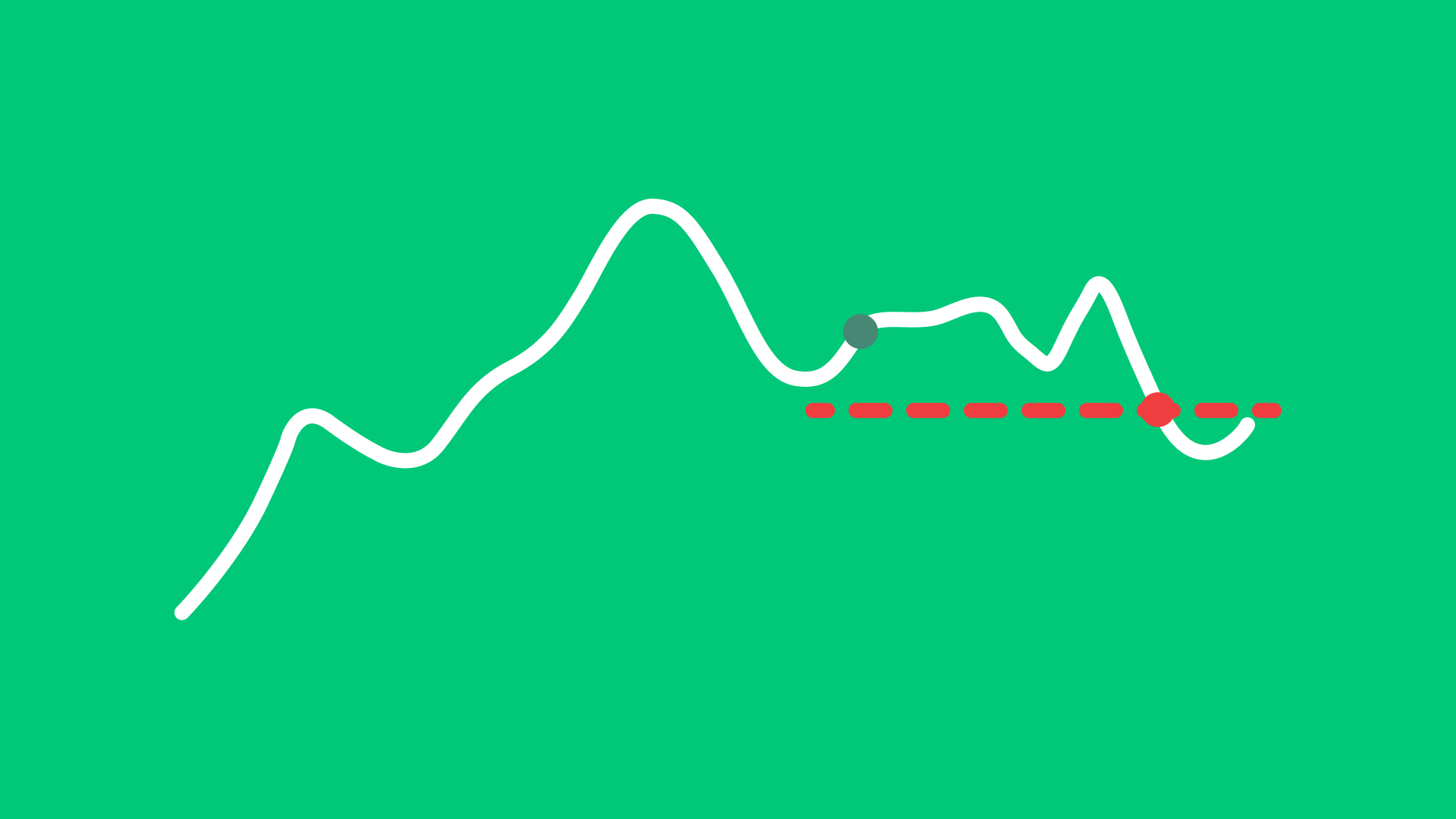

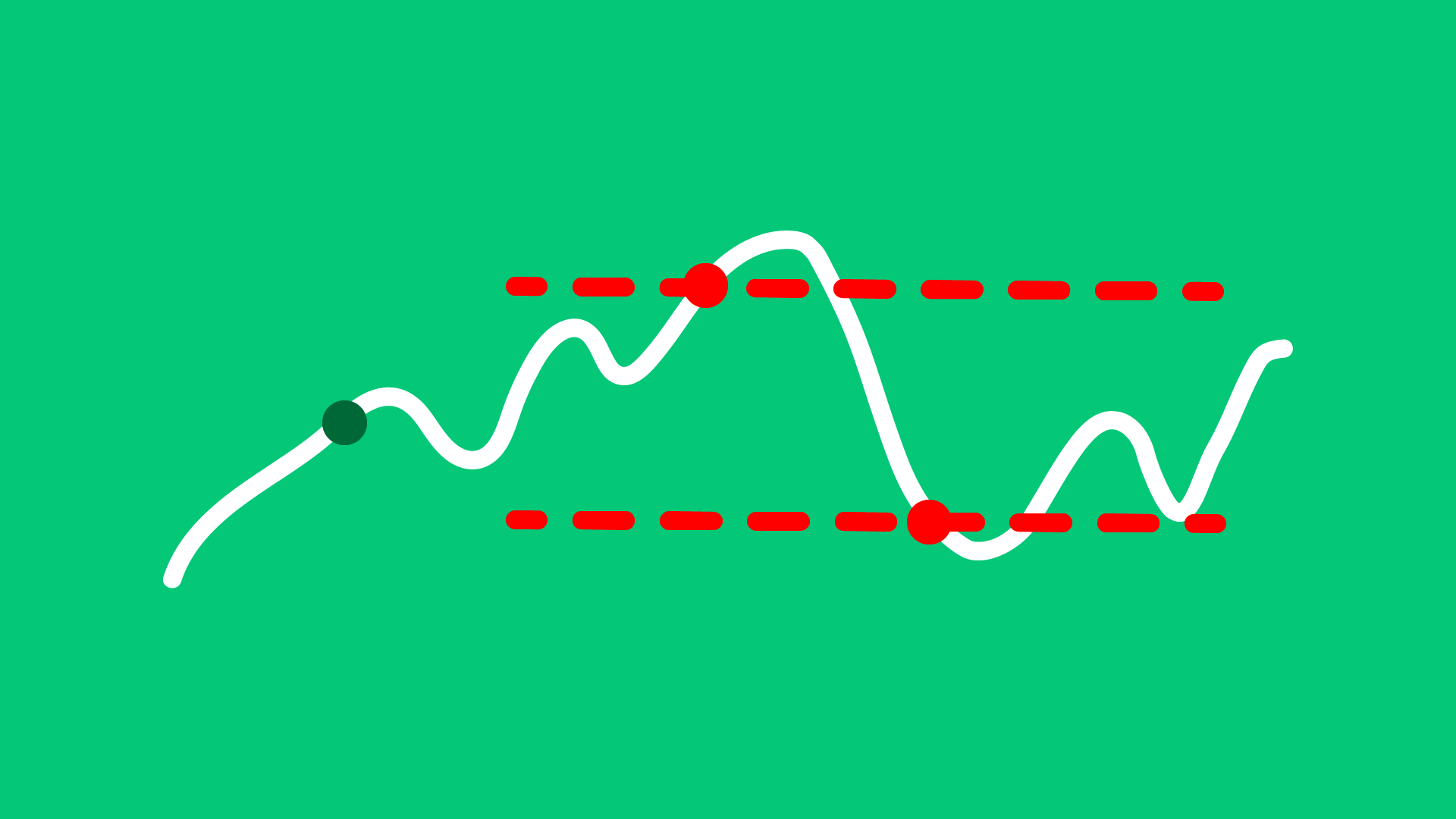

Sell Order

You specify the minimum price you are willing to accept. The order will only be executed at your specified limit price or higher.

Limit orders are useful in several scenarios, such as when a stock is experiencing rapid price fluctuations, and a trader wants to avoid an unfavorable fill that might occur with a market order. They are also useful, if a trader is not actively monitoring a stock but has a specific target price at which they are willing to buy or sell. Additionally, limit orders can remain open with an expiration date, ensuring that the order is executed only at the desired price.

Example (Buy Order):

Imagine you’re interested in buying 100 shares of ABC. Currently, ABC shares are trading around 30 EUR per share, but you want to buy them only if the price drops to 28 EUR per share or lower, based on your target price analysis.

To execute this strategy, you place a limit buy order for 100 shares of ABC at a limit price of 28 EUR per share. This means your order will only be executed if the market price of ABC shares drops to 28 EUR or below.

If the market price does not fall to 28 EUR, the order will remain active until it either meets your specified price or is canceled. If the price drops to 28 EUR, but there are only 50 shares available at that price, those 50 shares will be purchased, and the order for the remaining 50 shares will remain open until the price conditions are met or the order is canceled.

Example (Sell Order):

You would like to submit an order to sell 300 shares of XYZ at no less than 24 EUR. Instead of immediately selling at the current market price, you decide to place a limit order because you believe the value of XYZ shares will increase based on your market analysis.

Currently, XYZ shares are trading around 20 EUR per share, but you want to sell them only if the price reaches 24 EUR per share or higher. To achieve this, you place a limit sell order for 300 shares of XYZ at a limit price of 24 EUR per share. This means your order will only be executed if the market price of XYZ shares reaches or exceeds 24 EUR.

If the market price does not reach 24 EUR, your order will remain open until it either reaches your specified price or you cancel the order. If the price rises to 24 EUR, but there are only 200 shares available at that price, those 200 shares will be sold, and the remaining 100 shares will stay in the order until the price conditions are met or the order is canceled.

Advantages and disadvantages

Advantages

Disadvantages

- Price Control:

You can specify the exact price at which you want to buy or sell a security. This allows you to avoid paying more than you intended (for buy orders) or receiving less than expected (for sell orders).

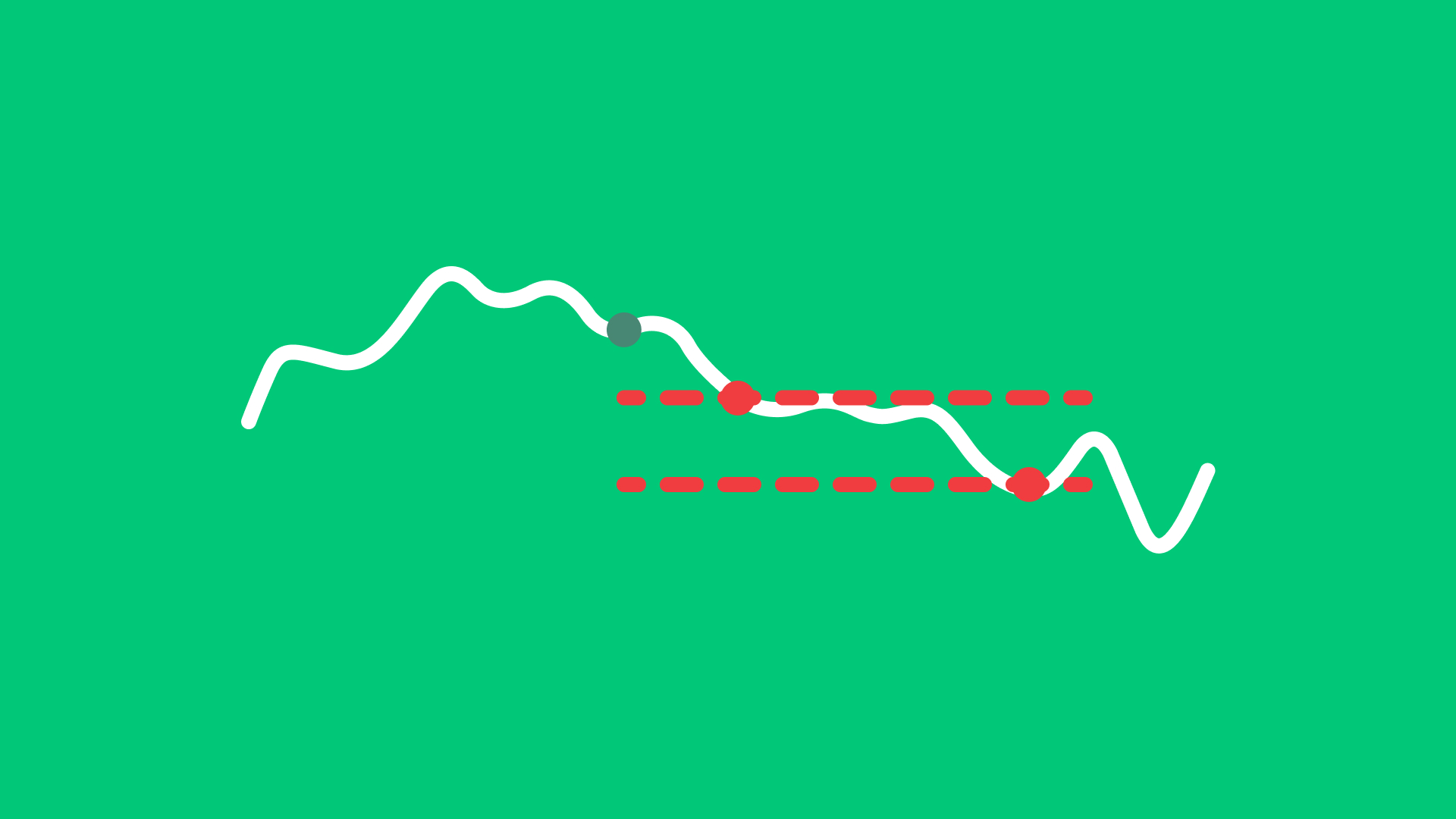

- Potential Non-Execution:

If the market does not reach your specified limit price, your order won’t be filled. This could result in missed opportunities if the price moves away from your desired level.

- Avoiding Slippage:

Slippage occurs when the market price moves unfavorably between the time your order is placed and when it is executed. Limit orders can help mitigate slippage risks because they only execute at your specified limit price or better.

- Risk of Partial Fills:

Depending on market liquidity and order size, limit orders may only partially fill at your specified price.

- Suitability for Volatile Markets:

Limit orders are particularly useful in volatile markets where prices can fluctuate rapidly. They provide protection against sudden price movements.

- Timing Risk:

There is a risk that the market may move quickly, and your limit order might not be fully executed if the price only briefly touches your limit but then moves away before your order can be completely filled.

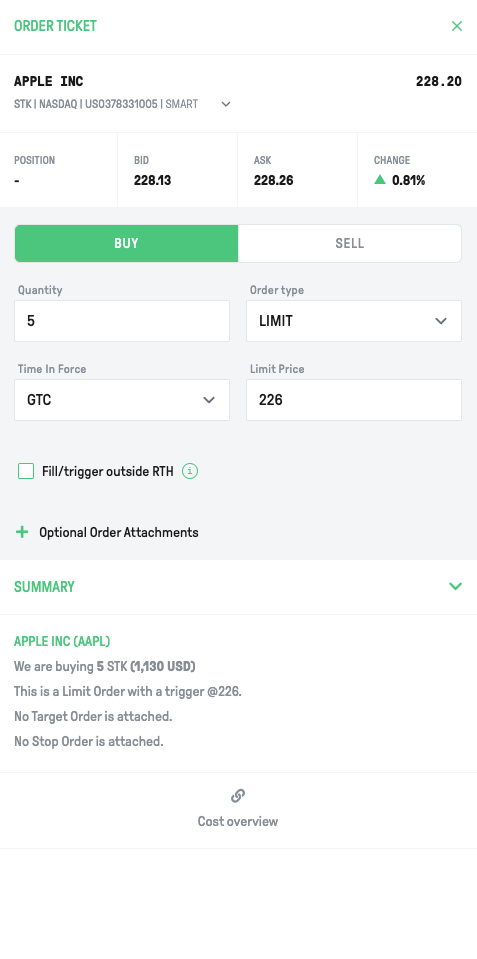

Submitting a Limit Order via LYNX

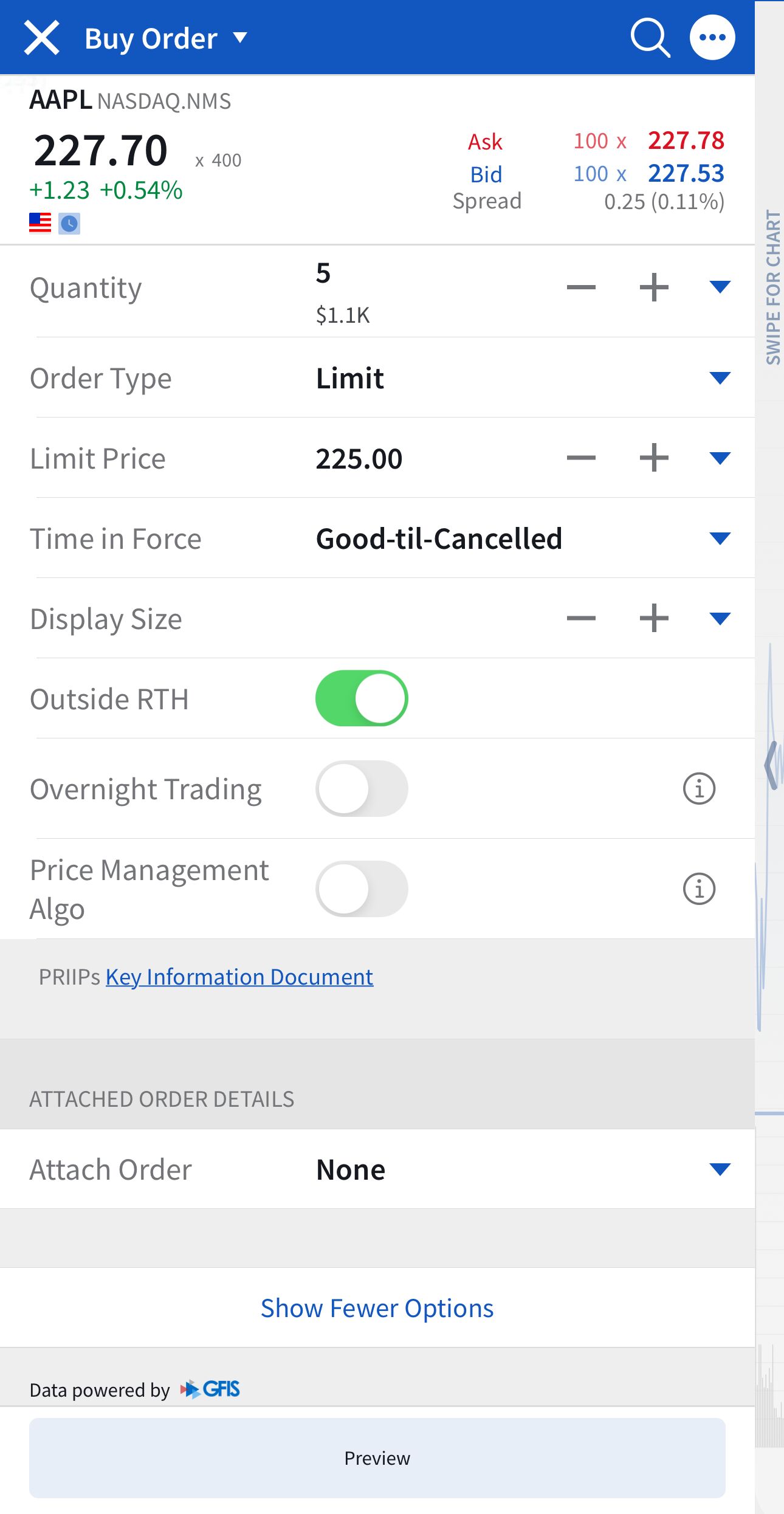

In LYNX+, you can find specific securities using the search bar located in the top right corner. You can search by the name, ISIN code, or specific ticker of the product.

Once you have selected the product you want to trade, you will be taken to the product overview. Here, in the top right corner, you can click on Buy or Sell if you wish to trade this stock immediately. Specify the Quantity and select Time in Force for your order.

Select LMT from the Order Type dropdown menu. Enter your limit price.

After customizing the order ticket to your preferences, you can review the order details in the Summary.

To proceed, click Send Order to submit or Cancel to discard the order.

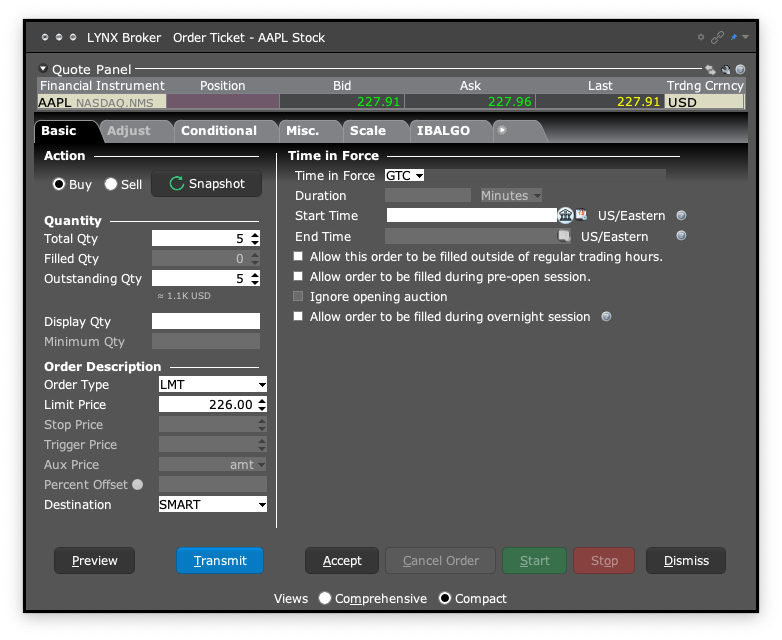

After logging in to the TWS, open the order ticket by clicking Order in the top left. If you have a specific security selected, it will automatically open an order ticket for that security. You can change the underlying security by typing the name, ticker code, or ISIN in the Financial Instrument column at the top of the order ticket.

Next, choose the action (buy or sell), specify the Quantity, the destination, and select the Time in Force for your order.

Select LMT from the Order Type dropdown menu. Define the limit price for your order in the field below.

In the bottom left of the order ticket window, you can press Preview to view the summary of your order. Then click on Transmit to submit the order or on Close to close the preview.

To search for a product, tap the Search icon in the top right. Enter the name, ISIN, or ticker symbol. Tap a search result to open the product’s page.

By clicking on Sell or Buy, you will access the order ticket.

Specify the Quantity and set the validity period of your order under Time in Force.

Select LMT as an order type and specify the limit price.

Before submitting the order, you can check the parameters of your order via the Preview/Calculator icon on the bottom right. To submit the order, swipe right over the Slide To Submit Sell/Buy button.

Tips before submitting a Limit Order

When submitting a limit order, it’s essential to consider several key points to ensure you achieve the best possible execution and minimize potential issues.

Price Setting

Ensure that the limit price you set is realistic based on the current market conditions.

If your limit price is too far from the current price, your order may not be filled.

Limit orders give you control over the price but may result in missed opportunities if the market doesn’t reach your chosen limit price.

Timing

Place your limit orders during regular trading hours when market liquidity is at its highest.

Avoid submitting limit orders during periods of high volatility, such as major news releases, as prices can move quickly, and your order may not be filled.

It’s also important to recognize the potential for market gaps that can affect execution.

Order Duration

Choose the appropriate duration for your limit order.

You can select from options like “Day” orders, which expire at the end of the trading day, or “Good ‘Till Canceled” (GTC) orders, which remain active until filled or manually canceled.

Using the right order duration can help ensure you don’t miss out on a good opportunity while also avoiding unwanted executions later.

FAQ

Yes, you can usually cancel or modify a limit order if it has not been executed yet.

Please note that the modification of a partially filled LMT order will cause the system to see it as a new order and commission will be deducted again.

A market order is executed immediately at the current market price, ensuring the order is filled quickly. In contrast, a limit order is only executed at your specified price or a better price. Market orders prioritize speed of execution, while limit orders prioritize achieving a specific price level.

You can use a limit order when:

- You wish to exert control over the price at which you purchase or sell a security.

- You have the flexibility to wait for the market to meet your specified limit price before executing the order.

- You aim to prevent purchasing above a desired price or selling below an intended price point.

Your limit order remains unfilled, awaiting the market to reach your specified limit price within the designated time frame, such as until the end of the trading day (DAY) or until canceled (GTC). If the market fails to meet this condition within the specified time frame, the order will either expire automatically or remain open, depending on the Time in force indicated.

A partial fill occurs when only a portion of your limit order is executed at the specified price. The remaining portion of the order will stay active until it is fully executed or cancelled.

If your limit (LMT) order is not completely filled by the end of the trading day, the system will typically treat any unfilled portion as a new order on the following trading day depending on the Time in Force selected. This means the order will remain active.

If the order with GTC selected as Time in Force isn’t entirely filled by the end of the trading day, it will be cancelled and submitted again on the next trading day. Any applicable commission fees will reset for the submitted order.

Modifying a partially filled order will also cause the system to view it as a new order and subsequently reset the commissions applicable for the modified order.