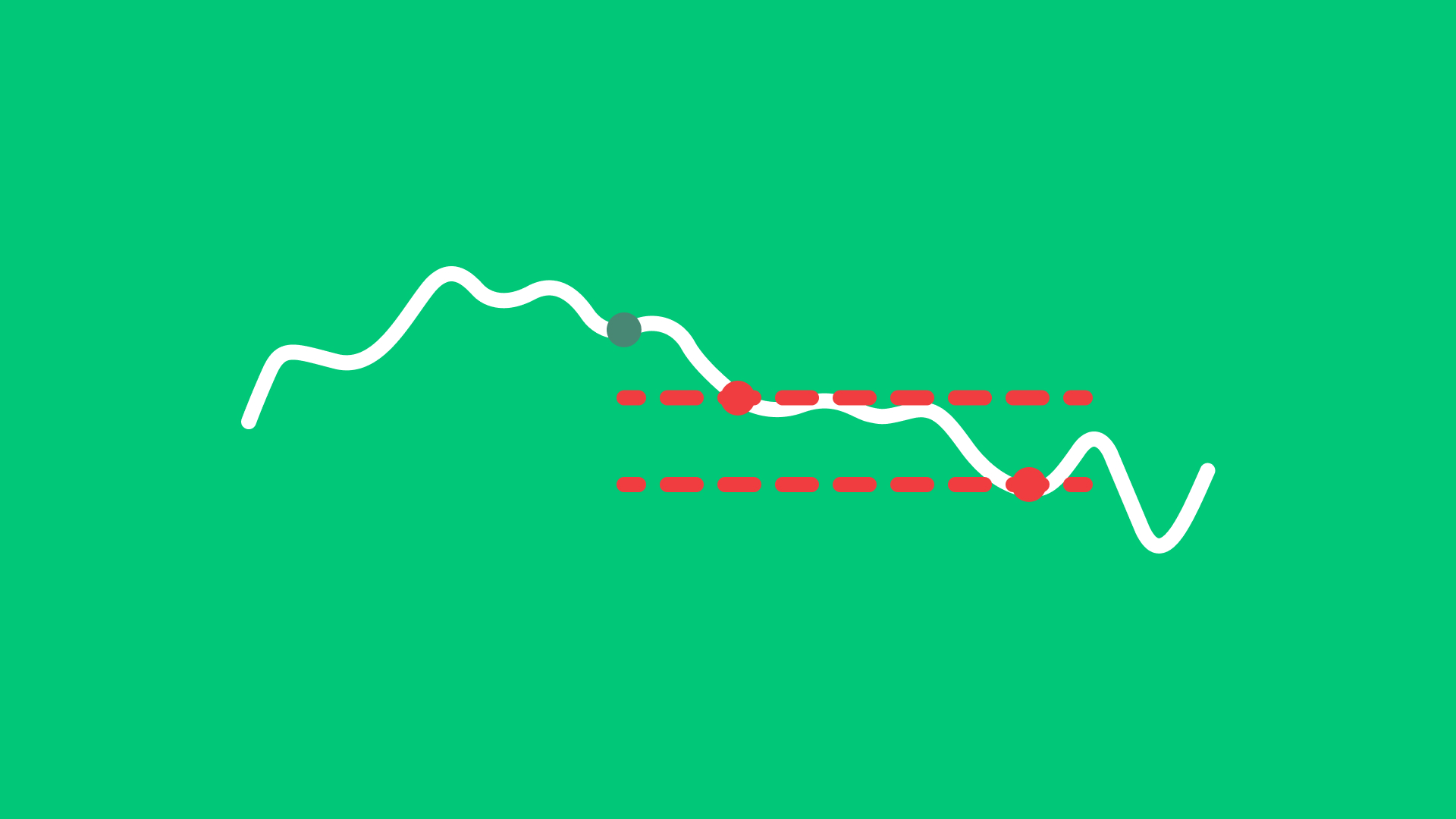

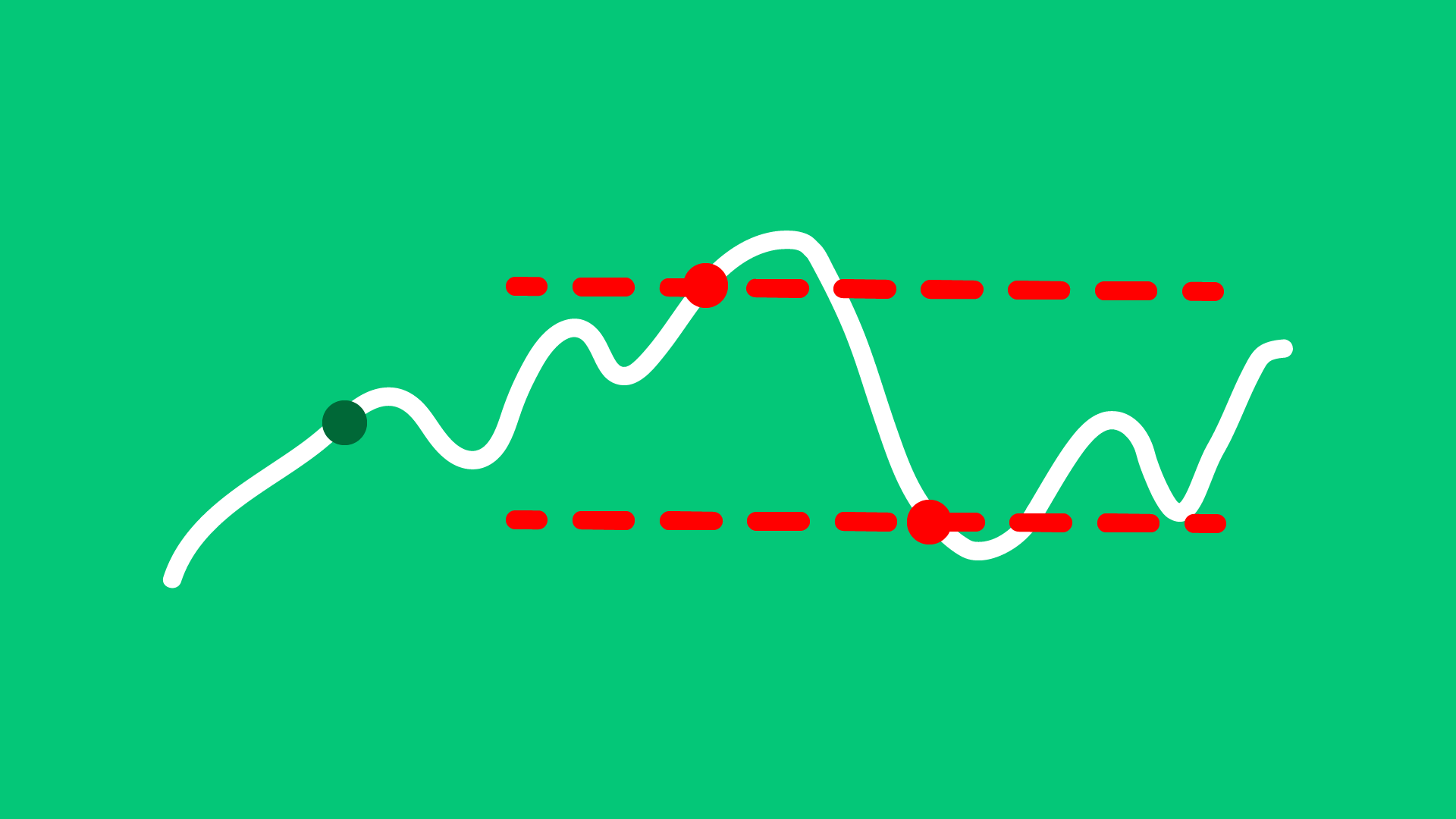

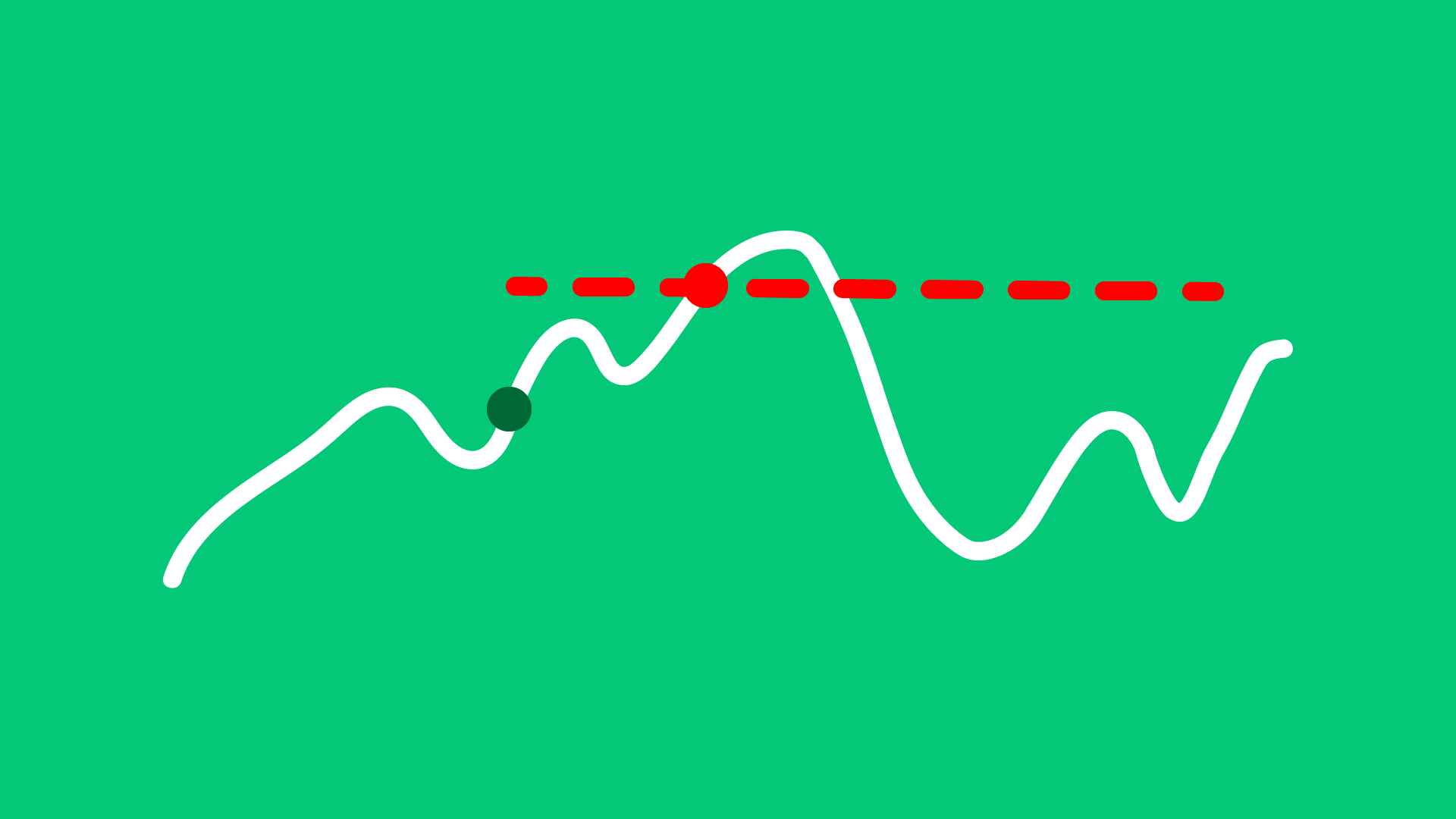

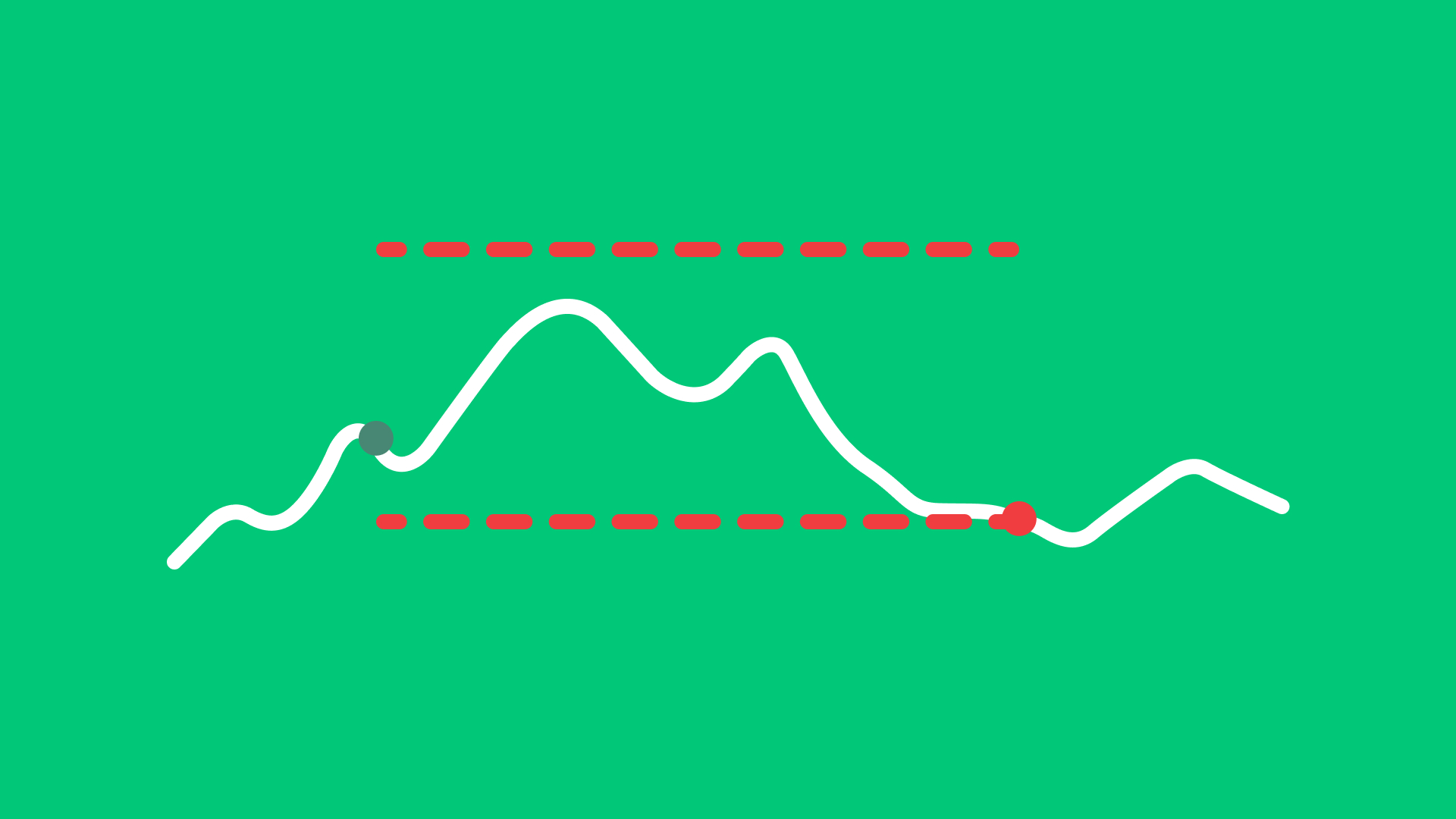

Order Types

One of the most important skills to have in trading is a comprehensive understanding of order types and order specifications. After all, every purchase or sale of a stock, option or certificate is carried out via an order that your online broker transmits to the stock exchanges.